Introduction

Governments around the world, particularly outside the United States such as Singapore, are showing a burgeoning interest in stablecoins that are not linked to the US dollar. Dea Markova, the director of policy at Fireblocks, shared insights on this trend during her discussion with Cointelegraph at the Token2049 event.

Geopolitical Aspirations and Market Dynamics

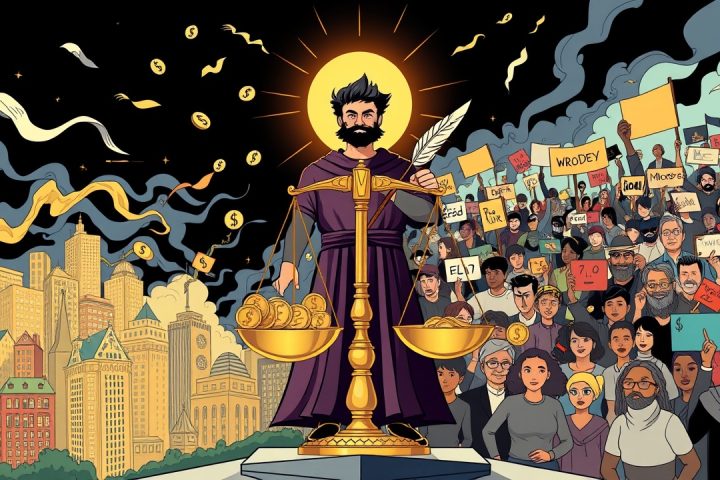

Markova emphasized that the ongoing competition among stablecoins reflects broader geopolitical aspirations, equating it to historical rivalries between governments and major American payment providers like Visa and Mastercard.

“The scenario today echoes those earlier tensions, particularly as non-dollar stablecoins begin to carve out their own place in the financial landscape, albeit still in the early stages.”

Markova noted that European Union regulators are raising concerns about dollar-pegged stablecoins, which are facing intense scrutiny despite being compliant with regulations. Central banks within the EU are reportedly troubled by the influence of these dollar-backed assets, with the European Central Bank pushing for a quicker rollout of a digital euro to counterbalance potential risks associated with US-centric stablecoins.

Systemic Risks and Market Share

A report from the Bank of Italy issued on April 29 underscored these concerns by indicating that the dependency of dollar-linked stablecoins on US Treasury bonds may create systemic risks within the eurozone economies.

In terms of market share, the data reveals a heavy dominance of dollar-pegged stablecoins. According to figures from DefiLlama, Tether’s USDT and Circle’s USDC together account for approximately 87.2% of the total market capitalization of stablecoins, which is $241.8 billion. All ten of the leading stablecoins are currently tied to the US dollar, showcasing the prevailing trend in the market.

Regulatory Developments in the UAE

Markova also highlighted the United Arab Emirates as a trailblazer in stablecoin regulation, pointing out that Abu Dhabi’s regulatory framework does not necessitate stablecoin issuers to be licensed or based in the emirate, which contrasts sharply with European regulations. This strategy allows for a more flexible approach to the global stablecoin market, enabling local businesses to access international liquidity and payment solutions.

As an illustration of this forward-thinking regulatory environment, USDT received recognition as a virtual asset in Abu Dhabi in December 2024, and shortly after, USDC gained regulatory approval on April 29. Furthermore, financial institutions in Abu Dhabi are also working on launching a stablecoin pegged to the dirham.

Conclusion

The shifting dynamics in the stablecoin market indicate a broader push for financial sovereignty among nations, as they navigate the complexities introduced by digital currencies and their implications for global finance.