Overview of OTC Trading for Virtual Assets

A recent surge in the over-the-counter (OTC) trading market for virtual assets underscores a growing demand among high-net-worth clients and institutional investors for confidential and large-scale transactions. OTC traders facilitate these trades by employing specialized trading mechanisms designed to shield these significant transactions from market fluctuations, thereby providing improved privacy and transaction security.

Recent Trends and Statistics

Recent statistics indicate a staggering 106% year-on-year increase in OTC trading activity in 2024, with stablecoins comprising approximately 95% of this volume, which itself grew by 147%. Geographically, Europe leads the charge in institutional OTC trading, capturing 38.5% of the market, followed by North America, Asia, and the Middle East at 15.4% each.

Regulatory Challenges and Compliance

However, as the OTC landscape evolves, regulatory challenges loom large for these traders. Operating within a relatively relaxed framework compared to traditional financial markets, OTC dealers are grappling with an uncertain compliance environment across various jurisdictions. With global regulations progressively tightening—particularly concerning anti-money laundering (AML) protocols and know-your-customer (KYC) requirements—OTC traders must adapt to rapidly changing legal landscapes.

Transactions often exceed market value transparency and are susceptible to risks like market manipulation, underscoring the imperative for stringent transaction fairness and stability measures.

Licensing and Regulatory Frameworks

One significant aspect of navigating these challenges is the push for OTC licenses, especially in fast-developing regulatory frameworks across key territories. Regions such as Hong Kong and the EU are moving towards establishing more structured requirements for OTC traders.

Hong Kong’s Legislative Proposal

In Hong Kong, a legislative proposal initiated by the Financial Services and Treasury Bureau (FSTB) in February 2024 aims to introduce a licensing system for OTC dealers under the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO). This system will mandate all virtual asset OTC service providers to apply for licenses, ensuring adherence to compliance standards related to AML and customer verification.

As of April 2025, the legislation remains under consultation, with specifics about its implementation yet to be determined. The core compliance requirements include rigorous AML and KYC policies emphasizing customer due diligence (CDD) procedures, particularly for large transactions.

EU Regulation: MiCA

Meanwhile, the European Union’s Markets in Crypto-Assets (MiCA) Regulation is establishing a cohesive compliance framework for crypto asset service providers, including OTC traders. Under this regulation, OTC dealers only need a compliance license from one EU member state to operate across the entire European Economic Area (EEA). MiCA mandates strict adherence to AML and KYC protocols, necessitating robust risk management frameworks to ensure market integrity and transparency.

Regulatory Landscape in the United States

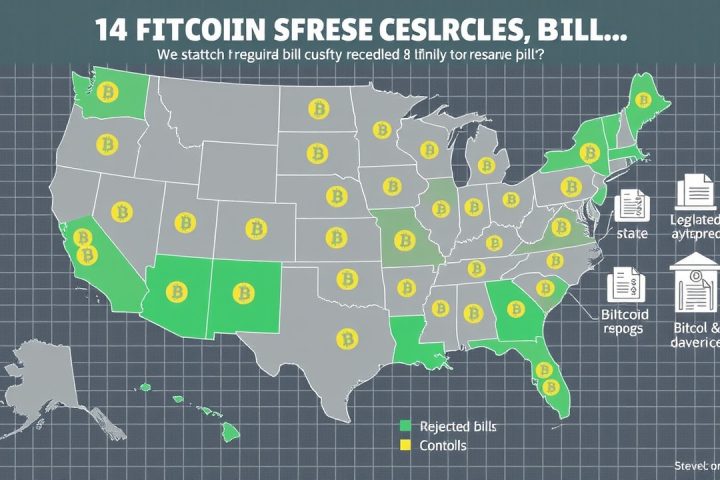

In contrast, the regulatory landscape for OTC traders in the United States remains fragmented, lacking a unified compliance structure. Regulations predominantly hinge on whether virtual assets are classified as securities, with agencies such as the SEC, CFTC, and FinCEN overseeing specific regulatory dimensions. Notably, New York’s BitLicense represents a localized approach whereby companies—including OTC traders—must secure a license to offer virtual currency services in New York State.

Compliance Strategies and Best Practices

Given these varied regulatory environments, compliance strategies for OTC traders must be flexible and tailored. Establishing dedicated compliance teams in major regions can aid in tracking local regulations, particularly useful in the U.S., where requirements differ from state to state. Furthermore, developing a comprehensive AML and KYC compliance framework that allows for adjustments based on local regulations can help mitigate risks associated with non-compliance.

In response to the potential for market manipulation, OTC traders are encouraged to employ real-time transaction monitoring systems to maintain transparency and ensure compliance with local market manipulation laws. As the regulatory landscape continues to evolve globally, regular compliance training and internal audits are essential for sustaining adherence to legal standards.

Conclusion

As the OTC trading ecosystem adapts, the acquisition of licenses becomes not just a legal formality but a key strategy to enhance market credibility and operational resilience against compliance risks.