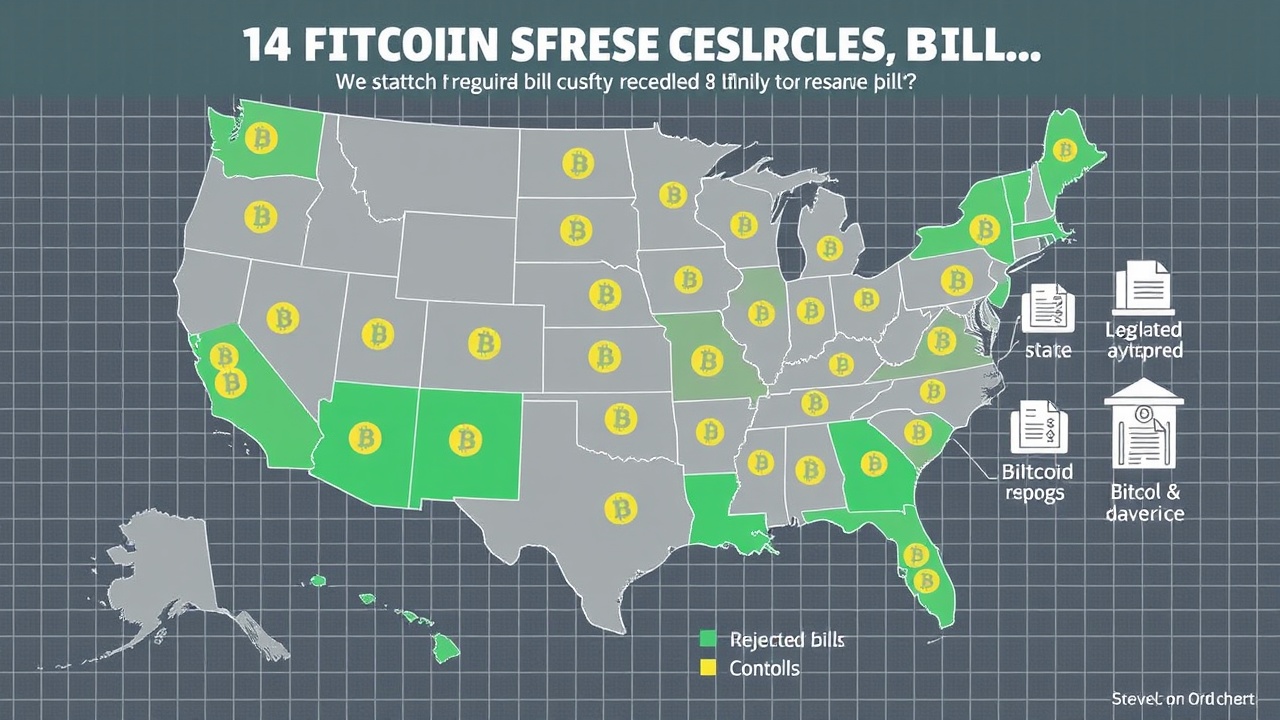

Overview of Bitcoin Legislation in the U.S.

Numerous states across the U.S. are navigating complex legislation aimed at establishing Bitcoin reserves, but many proposals have recently faced significant setbacks. While interest in digital assets persists—over half of U.S. states have explored or proposed bills related to Bitcoin—many ideas have faltered at various legislative stages.

State-Specific Legislative Developments

Florida

In Florida, two crucial bills aimed at integrating Bitcoin into state finances have been withdrawn. Both House Bill HB 487 and Senate Bill SB 550 sought to allocate as much as 10% of certain public funds to Bitcoin, including tax payments made in the cryptocurrency. However, the legislative session ended on May 3 without these bills reaching the House or Senate floor for a vote.

Oklahoma

Oklahoma also saw a setback on April 16, when the State Senate Finance and Taxation Committee narrowly voted against HB 1203, known as the Strategic Bitcoin Reserve Act. This legislation was designed to allow the state to invest up to 5% of four different state funds in digital assets, specifically targeting Bitcoin due to its market value stability over the past year. Interestingly, a last-minute change in a committee member’s vote towards support demonstrated some shifting perspectives on cryptocurrency investment among voters.

Utah

In Utah, plans fumbled in March after a provision for Bitcoin reserves was removed from a blockchain bill, resulting in the passage of HB 2030, which focused instead on individual rights within blockchain participation. The bill passed despite the absence of a reserve framework and received gubernatorial approval on March 25.

New Mexico

New Mexico’s attempt to invest 5% of its state funds in Bitcoin through SB 275 has also stalled—referred to committees and put on hold in early February. The bill’s sponsor has indicated intentions to revive the initiative in the future.

Montana and South Dakota

Montana’s House Bill 429 faced a defeat by a substantial margin on February 21, despite advocacy for it by some lawmakers as a means to diversify the state’s financial assets. South Dakota’s HB 1202 was similarly met with rejection in late February, winning just three votes in support out of twelve cast.

North Dakota

A proposal intended to explore Bitcoin reserves in North Dakota, HB 1184, failed in the House with a significant vote tally against it. However, the state is still considering a resolution that encourages investment in cryptocurrencies by its treasurer and investment board, hinting at ongoing interest in digital assets.

Pennsylvania and Wyoming

In Pennsylvania, HB 2664 aimed to allow for investments up to 10% in Bitcoin, but this initiative effectively died amid legislative maneuvering since its introduction last November. Meanwhile, Wyoming’s own Bitcoin investment proposal met a similar fate, failing to gain traction with only one supporting vote out of eight.

Arizona

Lastly, Arizona’s Governor Katie Hobbs vetoed the Arizona Strategic Bitcoin Reserve Act, which could have permitted the investment of state funds in cryptocurrencies. However, shortly after this setback, Arizona approved a different bill creating a crypto reserve that does not engage in direct investment but allows the state to manage unclaimed digital assets.

Positive Developments

On a more positive note, New Hampshire has emerged as a pioneer, becoming the first state to pass a strategic Bitcoin reserve bill. Other states like North Carolina and Texas are also advancing proposals that could see Bitcoin reserves established, but many remain buried in legislative red tape as public interest continues to evolve amidst ongoing debates regarding digital asset investments.

Currently, around 36 such bills are in various stages of deliberation across the nation, signaling a landscape still very much under development.