BlackRock Embraces Ripple’s RLUSD

In a transformative move for the world of institutional finance, BlackRock, the preeminent asset management firm globally, has embraced Ripple’s USD-backed stablecoin, RLUSD, for use as collateral. This development reflects an increasing confidence in the integration of blockchain technology within traditional financial systems.

Introduction of RLUSD

Ripple Labs introduced RLUSD in late 2024 as a fully regulated, enterprise-ready stablecoin, which is backed 1:1 by U.S. dollars and other premium liquid assets. Its adherence to rigorous compliance standards allows it to function across prominent blockchain networks, including Ethereum and the XRP Ledger. This adaptability has led to its swift adoption within institutional circles, thanks to its robust regulatory framework and efficient settlement capabilities.

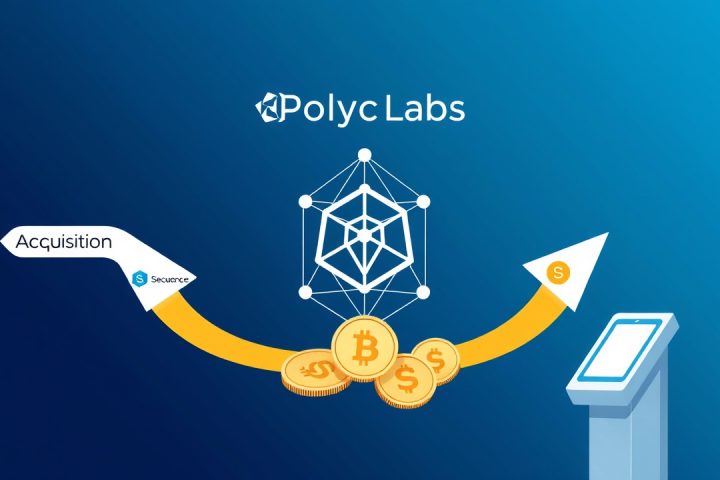

Strategic Alliance with Securitize

This initiative is part of a larger strategic alliance with Securitize, a prominent platform specializing in the tokenization of real-world assets. As a result of this partnership, investors within BlackRock’s USD Institutional Digital Liquidity Fund, known as BUIDL, can seamlessly exchange tokenized treasury fund shares for RLUSD via on-chain transactions around the clock. This capability positions RLUSD as a vital asset for digital brokerage and settlement.

Paradigm Shift in Institutional Transactions

The inclusion of RLUSD as collateral signifies a paradigm shift in institutional transactional processes. Unlike conventional finance, which is often impeded by sluggish, fiat-based settlement frameworks and limited operational hours, RLUSD offers instantaneous liquidity and transaction finality on a continuous basis. This innovation minimizes costs associated with intermediaries and enhances operational efficiency by bringing treasury-level assets closer to real-time liquidity.

Cross-Border Transaction Solutions

Beyond its role in collateralization, RLUSD is gaining traction as a solution for cross-border transactions—an area where Ripple has already established a strong foothold. By incorporating RLUSD into global payment infrastructures, financial institutions can facilitate faster, more transparent, and cost-effective international money transfers compared to traditional systems. This advancement leads to an adaptable global payments framework that meets the demands of large enterprises and corporate financial divisions.

Conclusion: The Future of Stablecoins

Ripple’s strategic direction embodies a significant evolution in the role of stablecoins, transitioning from speculative cryptocurrencies to integral components of financial infrastructure. BlackRock’s adoption of RLUSD, coupled with the growing number of partnerships across the institutional landscape, highlights increasing regulatory confidence and the fast-paced incorporation of blockchain technologies within mainstream finance.

This notable development underscores a pivotal shift in institutional finance, with BlackRock’s utilization of Ripple’s RLUSD representing a departure from experimental practices towards regulated and scalable financial solutions. By facilitating real-time transactions, providing 24/7 liquidity options, and enhancing cross-border payment efficiency, RLUSD exemplifies the potential for stablecoins to rectify existing inefficiencies in global financial markets. This milestone not only affirms Ripple’s strategic vision but also signifies a broader movement towards establishing blockchain-based currencies and tokenized resources as a foundational element for the future of financial services.