Class-Action Lawsuit Against Phantom Technologies

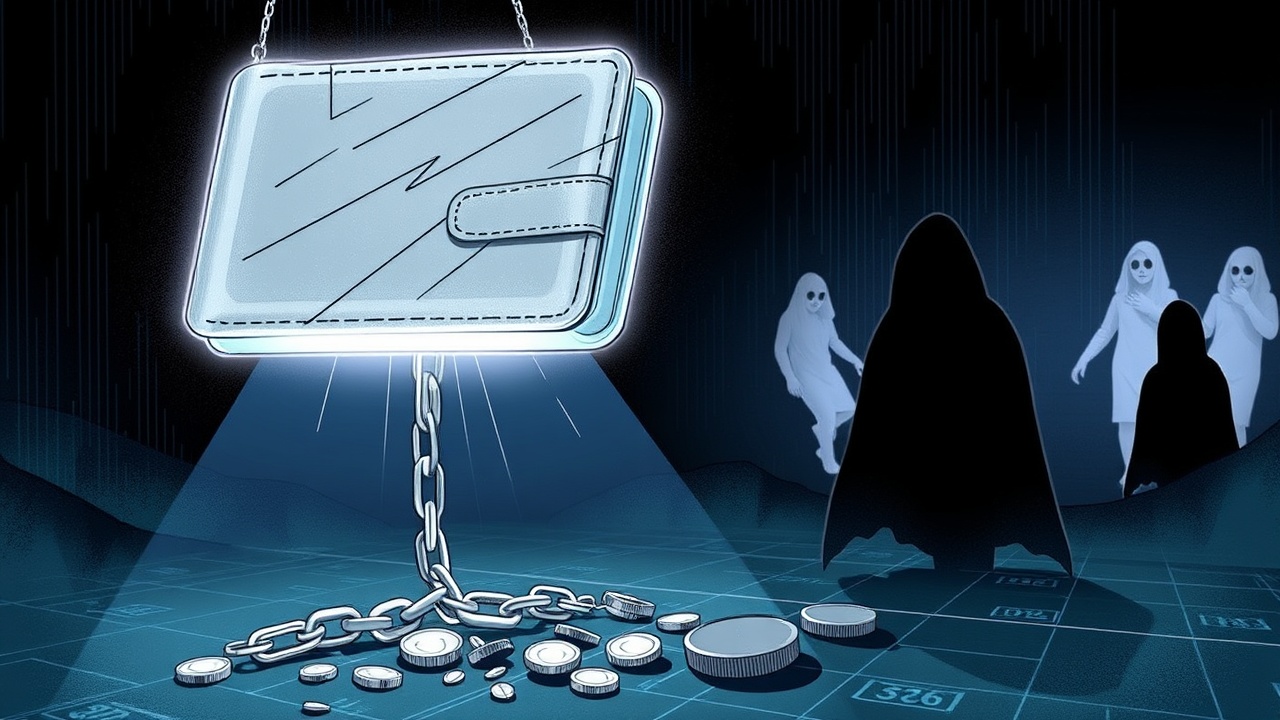

A class-action lawsuit was initiated on Monday against Phantom Technologies regarding significant security issues in its cryptocurrency wallet, Phantom. The complaint claims that these vulnerabilities led to the misappropriation of more than $500,000 in Wiener Doge (WIENER) tokens from a developer’s account.

Details of the Breach

Specifically, the court documents reveal that a hacker gained unauthorized access to a victim identified as Liam by infiltrating his personal computer and extracting private keys associated with his Phantom wallets from the web browser’s memory. This breach allowed the assailant to access Liam’s funds across three linked Phantom wallets without needing to circumvent any multi-factor authentication protocols.

Legal Action and Claims

The legal action was taken by Thomas Liam Murphy, founding partner of the crypto law firm Murphy’s Law, alongside 13 other plaintiffs, and it was filed in the Southern District of New York. They contend that Phantom’s design issues exposed its users to significant risks of malware and theft, despite the company’s promotion of its security as “top-tier.”

Phantom’s Market Position and Allegations

With a valuation exceeding $3 billion, Phantom is a leading wallet service for users of the Solana blockchain, holding around $25 billion in assets across a user base of 10 million. Central to the lawsuit is the assertion that Phantom kept users’ private keys in an unencrypted format within browser memory, which, according to the plaintiffs, enabled malware to extract these sensitive keys.

Company’s Response and Additional Allegations

Murphy alleges that upon reporting the hack to Phantom, the company claimed to operate “a noncustodial wallet,” effectively placing full liability for the loss on Murphy himself. Additionally, the lawsuit describes how the attacker utilized Phantom’s integrated “Swapper” feature to convert the stolen Wiener Doge tokens into only $37,537 worth of Solana (SOL), representing a drastic devaluation that adversely affected the Wiener Doge project, which at one time had a market cap of $3.1 million as per GeckoTerminal data.

Defendants and Damages Sought

The defendants also include the cryptocurrency exchange OKX, which partnered with Phantom in late 2024. The lawsuit references a previous admission of guilt by OKX in federal court concerning money laundering activities involving $5 billion in illicit transactions. The plaintiffs argue that Phantom’s failure to disclose its connection with OKX constituted deceptive practices.

The lawsuit seeks damages totaling at least $3.1 million, alleging that Phantom contravened the Commodity Exchange Act by acting as an unregistered trading venue while shielding itself from regulatory scrutiny through misleading claims of decentralization. As of now, Phantom has not yet publicly responded to these allegations, and requests for comments from Phantom, Murphy, and OKX were unanswered.