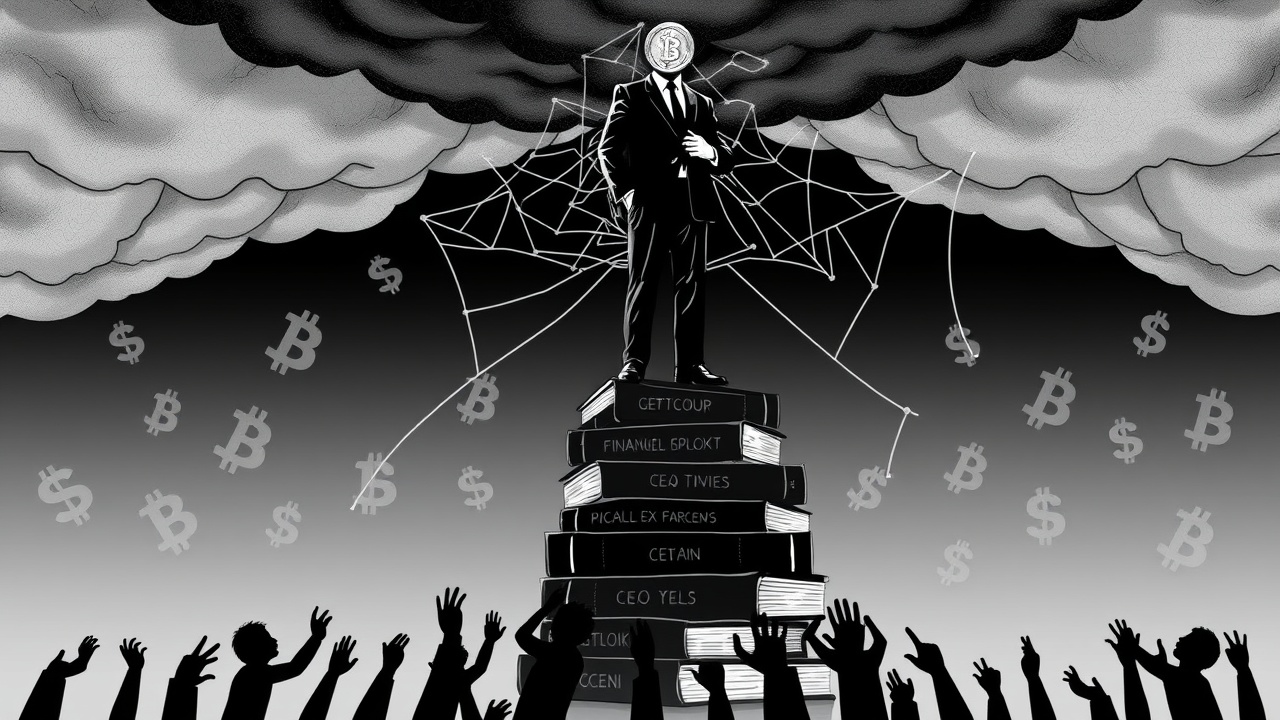

CEO Admits Guilt in Bitcoin Ponzi Scheme

Ramil Ventura Palafox, the CEO of Praetorian Group International, has admitted guilt in a Virginia court this week regarding charges of wire fraud and money laundering related to a colossal Bitcoin Ponzi scheme. At 60 years old, Palafox, who holds dual citizenship in the United States and the Philippines, was a prominent figure leading PGI as its chairman and chief executive.

Details of the Fraudulent Operation

Prosecutors revealed a staggering operation that deceived over 90,000 investors, resulting in losses amounting to at least $62 million from a total investment of $201 million, which included more than 8,100 Bitcoin valued at roughly $171 million at the peak of the scheme.

Between December 2019 and October 2021, PGI promoted a fake Bitcoin trading program that promised investors daily returns ranging from 0.5% to 3%, but the program never functioned as advertised. Instead, funds from newcomers were misappropriated to pay prior investors or indulged in extravagant personal expenditures. Palafox is reported to have lavishly spent about $3 million on luxury vehicles and over $6 million on multiple properties in Las Vegas and Los Angeles, alongside additional funds for high-end brands such as Rolex, Cartier, and Gucci.

Deceptive Practices and Industry Impact

The company’s online portal deprived investors of their awareness, displaying fraudulent account balances and fictitious earnings, a tactic designed to create a sense of security until the scheme collapsed from the increasing number of withdrawal requests. Dan Dadybayo, who is involved in research strategy at Unstoppable Wallet, remarked that Praetorian exhibited all characteristics of a Ponzi scheme intertwined with multi-level marketing tactics, where profits are generated not from selling services but rather through onboarding new members.

This case bears resemblance to notorious frauds such as BitConnect and OneCoin. However, Dadybayo points out that compared to the extensive fallout from failures like FTX or Mt. Gox, Praetorian’s collapse may not have a lasting impact on the cryptocurrency industry. Instead, it could lead to heightened skepticism surrounding the term ‘arbitrage’ while enabling compliant regulated entities to showcase their adherence to laws as a marketing advantage.

Regulatory Challenges and Future Sentencing

According to Dadybayo, the perpetuation of such fraudulent schemes is fueled by universal greed, coupled with an inability of regulators to address every individual case due to resource constraints. As for Palafox, he is slated for sentencing on February 3, 2026, and may face a maximum of 40 years in prison. He has consented to a restitution agreement of $62.7 million, though actual sentencing often falls short of the maximum penalties.

Dadybayo concluded with a call for regulators to focus more on fostering financial literacy and awareness of red flags regarding fraudulent activities, instead of continuously expanding Know Your Customer and Anti-Money Laundering measures.