Identity Verification in Decentralized Finance

The U.S. Treasury Department is currently weighing the implementation of identity verification mechanisms within decentralized finance (DeFi) smart contracts, a proposition that faces significant backlash for potentially undermining the principles of open and permissionless finance. This discussion arose last week as part of a public consultation following the recent introduction of the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), signed into effect in July. The Act mandates the Treasury to assess new compliance measures aimed at curbing illicit activities in cryptocurrency markets.

Proposals for Identity Integration

Among the proposals is the idea of integrating identity credentials directly into smart contracts. This would allow a DeFi platform to verify a user’s government-issued ID, biometric information, or digital wallet certificate before permitting financial transactions. Proponents of this approach believe that embedding Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures into the blockchain framework could facilitate compliance and deter criminal activity.

Fraser Mitchell, the Chief Product Officer at SmartSearch, an AML solutions provider, expressed to Cointelegraph that these measures could unveil the anonymous transactions that attract illicit actors to these networks. He emphasized that live monitoring for suspicious conduct would enable platforms to manage risks more effectively and prevent misuse.

Concerns Over Privacy and Decentralization

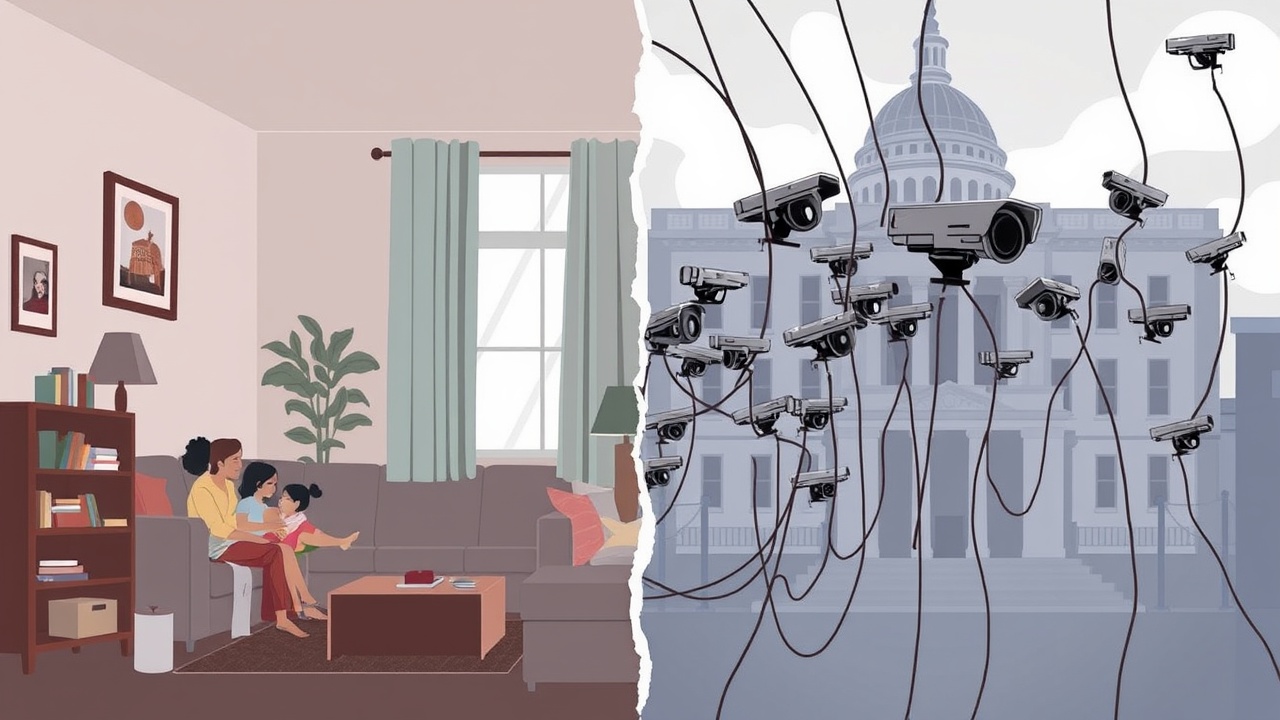

However, critics warn that this initiative could fundamentally alter the nature of DeFi. Mamadou Kwidjim Toure, CEO of Ubuntu Tribe, likened the proposal to installing surveillance cameras in private homes. He argued that while it may seem like an efficient compliance solution, it essentially transforms a neutral, open infrastructure into one that requires government-sanctioned identity verification, drastically altering the essence of decentralized finance.

Toure pointed out that tying biometric or governmental IDs to blockchain wallets means every transaction would potentially be permanently linked to a real individual, thus sacrificing anonymity and privacy. He voiced concerns that such a shift not only impacts compliance but also jeopardizes financial freedom, stating that embedding identity at the fundamental protocol level sets a dangerous precedent. He foresees risks including potential transaction censorship, wallet blacklisting, and automated tax collection enforced through smart contracts.

Inclusivity and Data Privacy Issues

The implications of these identity requirements extend to inclusivity as well. A significant portion of the global population, including undocumented individuals, migrants, and refugees, operates without formal identification. Requiring government-issued IDs to access DeFi platforms could alienate entire demographics, infringing upon the fundamental accessibility that decentralized finance promises.

Data privacy and security are additional concerns, particularly with the risks associated with linking sensitive biometric data to financial transactions, which could result in catastrophic breaches exposing both monetary assets and personal identities.

Exploring Alternative Solutions

Experts argue that there is a middle ground that does not necessitate choosing between becoming a hub for criminal activities and subjecting users to extensive surveillance. Alternatives such as zero-knowledge proofs (ZKPs) and decentralized identity (DID) technology could allow for the verification of eligibility without compromising full identity disclosure. For instance, ZKPs enable users to confirm they are not on sanctions lists or are of legal age without revealing their personal identities, while DID systems permit ownership of verifiable credentials that individuals can choose to share selectively.

Toure emphasized that adopting a model where users control their own credential disclosures might be a more suitable approach than insisting on static government-issued IDs.