Introduction

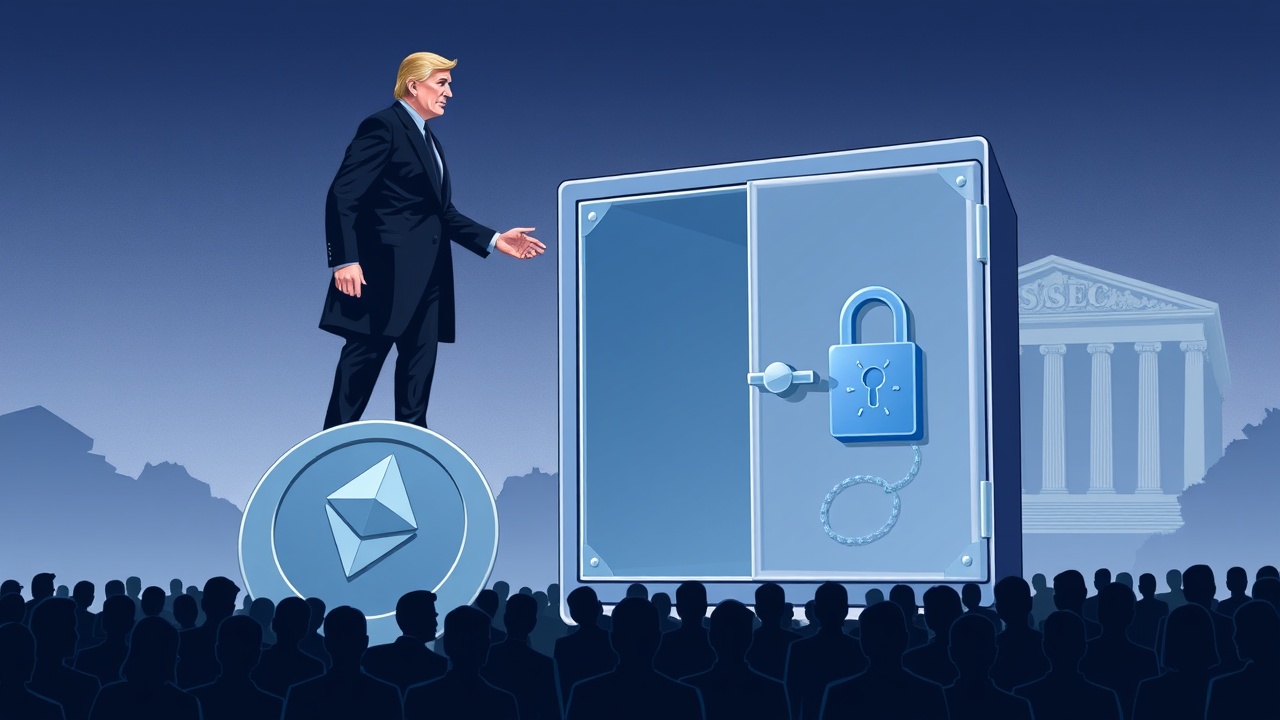

In a significant move aimed at enhancing transparency within the cryptocurrency sector, U.S. Representative William Timmons (R-SC) has urged the U.S. Securities and Exchange Commission (SEC) to disclose internal documents regarding the status of Ethehex (ETH) as a potential security. Timmons’s letter, dispatched on June 10, calls attention to what he perceives as regulatory inconsistency from the SEC, which has led to substantial confusion among investors and market participants in the U.S.

Regulatory Inconsistencies

Historically, the SEC has displayed contradictory positions on ETH. Back in 2018, a senior official from the agency asserted that Ethereum was not classified as a security. Fast forward to April 2023, when former SEC Chair Gary Gensler appeared before Congress but refrained from clarifying the agency’s stance on Ethereum’s security designation, leaving the issue in limbo. Shortly after Gensler’s testimony, the SEC initiated an inquiry into ETH titled “In the Matter of ETH 2.0,” signaling a shift in their oversight approach.

Compounding Confusion

Complicating matters further, the SEC approved the listing of spot exchange-traded funds (ETFs) linked to ETH in May 2024, a decision that would generally indicate a non-security status for the cryptocurrency. By June 2024, the commission concluded the investigation pertaining to ETH 2.0. Timmons argues that these conflicting actions have generated “destabilizing confusion for millions of American crypto-market participants,” highlighting the urgency for clarity.

The Call for Transparency

Timmons asserts that the release of the requested documents is vital not only for the ongoing dialogue within the cryptocurrency space but also for public understanding of the SEC’s historical interpretation of securities laws. The documents sought by Timmons encompass emails and other communications tied to Ethereum’s analysis, including discussions that were previously withheld during a FOIA request and litigation pursued by History Associates on behalf of Coinbase.

Conclusion

Timmons stressed that making these findings public will shed light on the shifting perspectives regarding ETH under Gensler’s chairmanship. Additionally, it could illuminate the broader implications of the SEC’s regulatory tactics, particularly the preferred method of “regulation by enforcement,” which during the previous administration, hindered innovation within the burgeoning crypto industry.