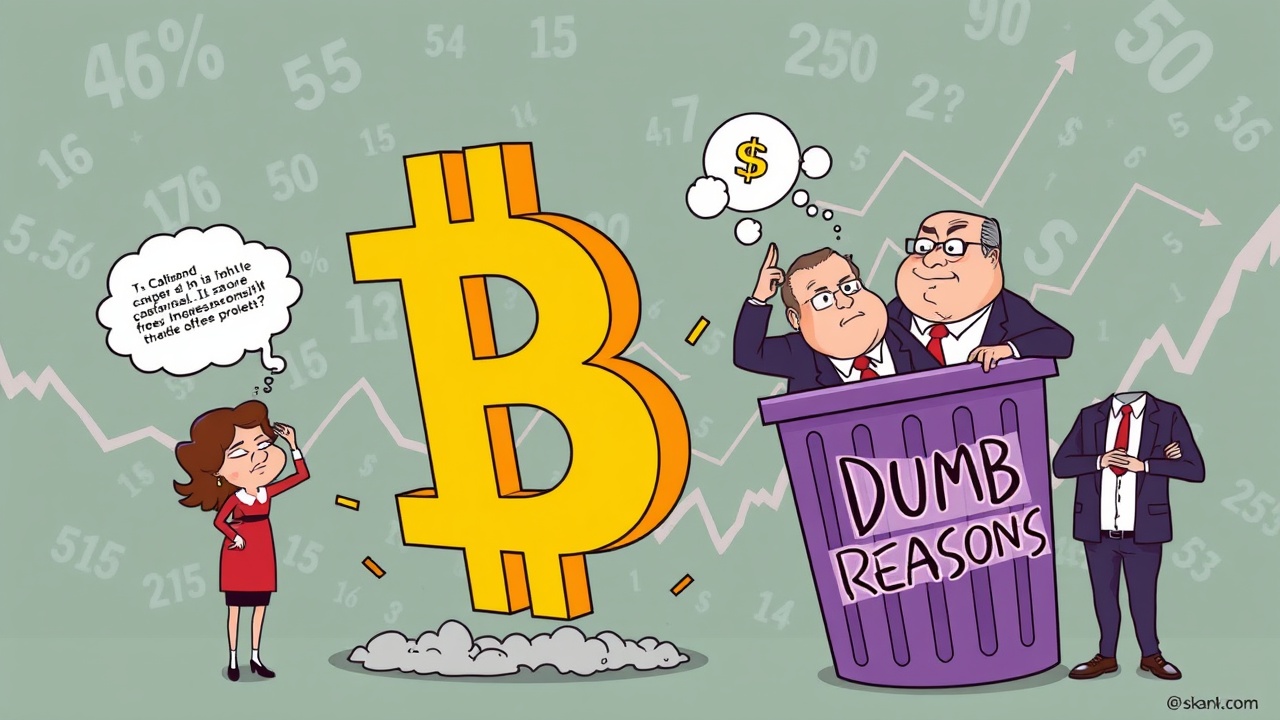

Criticism of Cathie Wood’s Bitcoin Assertions

Prominent Canadian businessman and mining executive Frank Giustra has sharply criticized Ark Invest’s Cathie Wood concerning her latest assertions about Bitcoin. Giustra, known for his pro-gold stance and skepticism towards contemporary monetary strategies, labeled Wood’s reasoning as the “dumbest reason to buy Bitcoin”.

Context of the Criticism

This remark followed Wood’s appearance on a podcast where she suggested that the U.S. government plans to acquire 1 million Bitcoin for a strategic reserve, ostensibly to prevent a potentially weak political position in the upcoming midterm elections.

Giustra’s Dismissal of Wood’s Predictions

Giustra dismissed Wood’s prediction as nonsensical and took the opportunity to critique her historical performance in fund management, claiming that

“it’s no wonder she has the worst track record on Wall Street.”

Reality of the U.S. Government’s Bitcoin Holdings

While Wood envisions a future where the U.S. amasses Bitcoin to safeguard its position, the reality, according to U.Today, has been less promising. Instead of purchasing, the government’s “strategic Bitcoin reserve” simply entails ceasing the sale of Bitcoin already in its possession, which has left many disappointed.

Wood’s Optimism for Bitcoin’s Future

During her podcast appearance, Wood remained optimistic, suggesting that a U.S. commitment to acquire Bitcoin could influence other nations to reconsider their monetary holdings. She argued,

“If the US actually says, ‘Okay, now we’re going to buy,’ that’s going to compel a lot of other governments to evaluate their positions. No one wants to be at the mercy of the dollar and American fiscal policy.”

Wood advocates for Bitcoin as a viable component of national reserves.