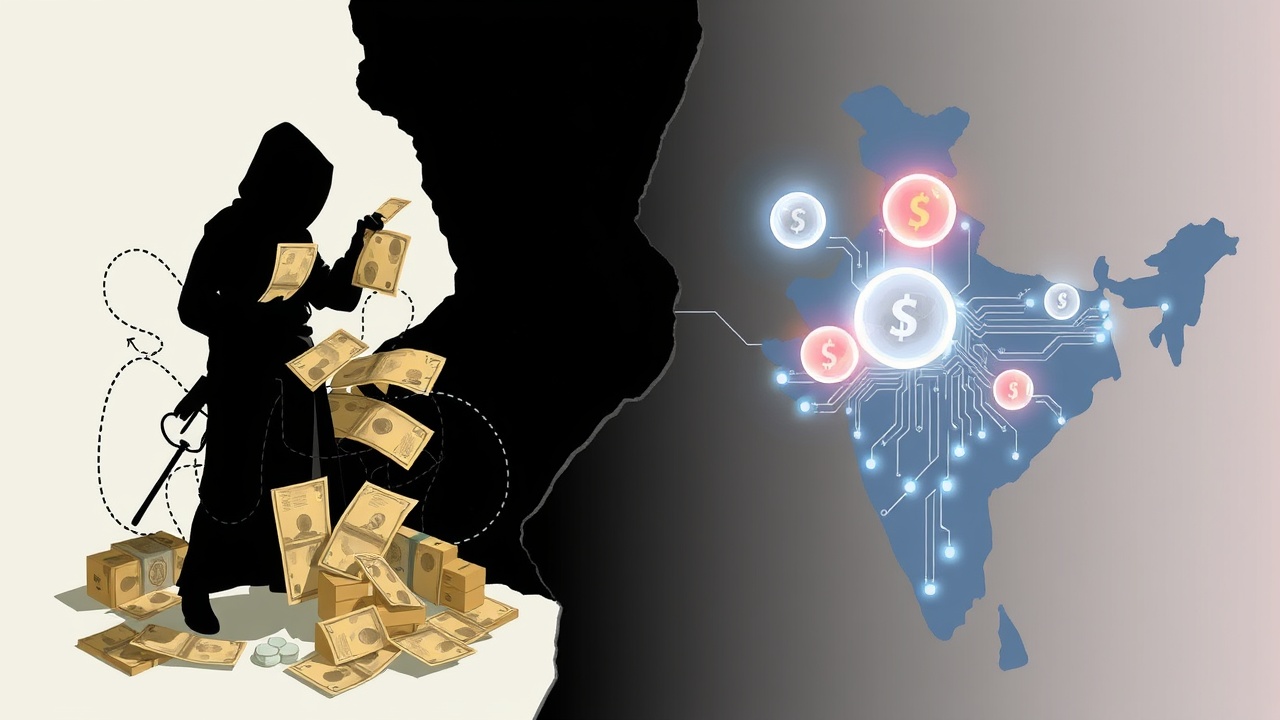

Cryptocurrency and Illicit Trade: A Growing Concern

The Directorate of Revenue Intelligence (DRI) of India has issued a crucial alert regarding the escalating involvement of cryptocurrencies and stablecoins in the illicit trade of drugs and gold. Their recent Smuggling in India Report 2024-25, published on Thursday, highlights how these digital currencies facilitate swift and untraceable financial transactions across borders, effectively evading standard financial regulation.

Key Findings from the Report

According to the report, cryptocurrencies have become a popular medium for smuggling operations because of their decentralized and anonymous characteristics, which allow for minimal oversight and poor compliance with anti-money laundering regulations.

“Cryptocurrency has emerged as a potent tool for smuggling syndicates due to its decentralised, pseudonymous, and borderless nature,”

the report elaborates, underscoring the reliance on these digital assets to process illicit payments, especially in drug and gold trafficking activities.

Notable Incidents of Smuggling

One notable incident cited involved a large international gold smuggling operation last July, where authorities intercepted 108 kg of gold smuggled through the Indo-China border. The proceeds, amounting to over $12.7 million (or ₹108 crore), were funneled to China using hawala networks and Tether’s stablecoin, USDT, after the sale of the gold in Delhi. The DRI revealed that the orchestrator, based in China, utilized various cryptocurrency wallets to obscure the transaction trail and communicated using encrypted applications like WeChat, leveraging virtual private networks (VPNs) for added security. Analysis of communications, transaction hashes, and wallet IDs provided critical evidence that helped trace the smuggling activities effectively.

Regulatory Challenges and Recommendations

Musheer Ahmed, the Founder and Managing Director of Finstep Asia, commented on the challenges faced by regulators worldwide in detecting such transactions. He noted that the absence of robust cryptocurrency regulations in many regions creates gaps that criminals exploit. He advocated for a proactive regulatory framework that would allow authorities to filter out compliant operators, enforce Know Your Customer (KYC) protocols, and enhance transaction monitoring capabilities to mitigate the risks associated with the misuse of virtual currencies.

Ahmed also cautioned that outright bans on cryptocurrency could drive illicit activities underground, creating additional barriers to monitoring and legitimate uses of tokenized assets that facilitate international trade. He emphasized the necessity for law enforcement and regulatory bodies to receive training focused on virtual asset activities to respond more effectively to suspicious transactions.

Rising Incidents of Cryptocurrency-Related Crime

The DRI’s report surfaces amid rising incidents of cryptocurrency-related criminal activity in India. Earlier in June, for instance, the Central Bureau of Investigation detained Delhi resident Rahul Arora, seizing over $327,000 in cryptocurrency tied to a transnational cybercrime scheme aimed at American and Canadian victims. Additionally, in July, the Narcotics Control Bureau apprehended a 35-year-old engineer from Kerala involved in a darknet drug trafficking ring named “Ketamelon”, where LSD, ketamine, and $82,000 in cryptocurrency were confiscated. The investigation indicated that he procured narcotics globally and laundered the proceeds using the privacy-centric cryptocurrency Monero.

Conclusion

The DRI’s report also acknowledges that while the inherent traceability of blockchain transactions could aid intelligence efforts, the fast-evolving landscape of digital assets necessitates the establishment of more stringent regulatory measures, improved anti-money laundering practices, and cutting-edge forensic tools, backed by global partnerships to prevent the misuse of cryptocurrencies.