Debate Over Ethereum’s Staking Figures

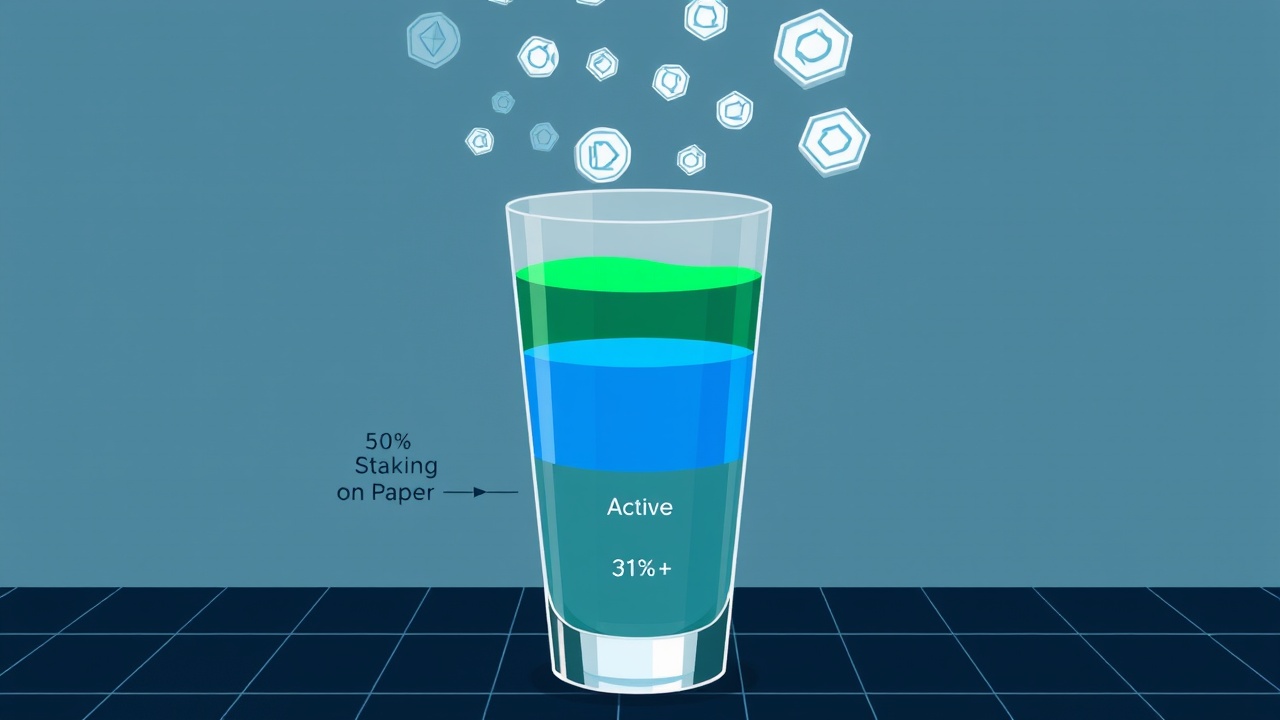

A debate has arisen within the blockchain analytics community regarding Ethereum’s staking figures, with one prominent firm claiming that staking activity has exceeded 50% of the cryptocurrency’s total supply, a figure that another firm vehemently disputes.

Claims by Santiment

Santiment, specializing in on-chain analytics, recently reported a historic milestone, indicating that Ethereum (ETH) staking has reached 50.18% of its total supply based on data from the staking deposit contract. This figure marks a significant moment in the Ethereum ecosystem as it potentially implies a high level of commitment from stakeholders.

Concerns Raised by CoinShares

However, CoinShares, another leading analytics organization, has raised concerns over the validity of Santiment’s findings. According to their analysis, the staking percentage should be viewed with skepticism. Luke Nolan, a senior research fellow at CoinShares, argued that the way staking data is recorded could be misleading, emphasizing the distinction between deposits and actual staked Ether.

Nolan pointed out that the figure reported by Santiment reflects the total amount of Ether deposited for staking, approximately 80 million, rather than the active balance currently staked in the network. He noted that this deposit-only record excludes withdrawals that have not been accounted for, which are essential for determining the actual active stake.

True Active Staking Volume

CoinShares estimates that the true active staking volume, which directly contributes to the network’s security and validity, stands at roughly 37 million Ether, translating to around 30.8% of the total supply. This figure aligns with assessments from other industry analysts who also suggest that the effective staking rate hovers around 30%.

The ongoing dispute highlights the challenges in accurately gauging Ethereum’s staking landscape, particularly as the network continues to evolve and grow.