Hong Kong’s Crackdown on Cryptocurrency Fraud

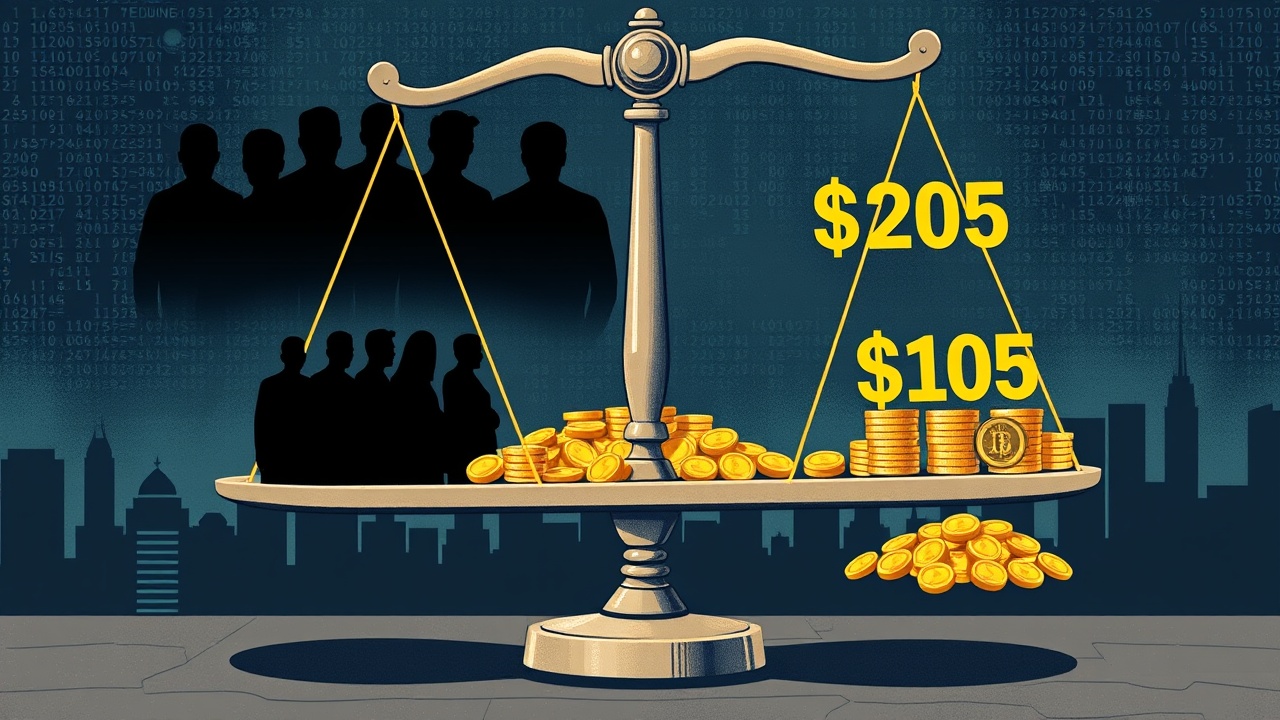

In a significant crackdown on cryptocurrency fraud, Hong Kong’s law enforcement has brought charges against 16 individuals, including the well-known social media influencer and former attorney Joseph Lam Chok. The group is implicated in a massive fraud scheme associated with the unlicensed platform JPEX, which has reportedly defrauded investors of around $205 million (approximately HK$1.6 billion).

Details of the Investigation

This action follows a thorough investigation spanning two years, which found that over 2,700 investors were lured into the scheme through a network of social media influencers and physical crypto outlets that funneled investor deposits into JPEX without proper licensing. The allegations against the suspects include fraud, conspiracy to defraud, and money laundering, as reported by the South China Morning Post.

Joseph Lam was among several influencers detained in September 2023, following warnings from the Securities and Futures Commission (SFC) about JPEX’s illicit operations. The arrest coincided with numerous complaints from users regarding frozen withdrawals, which catalyzed the police inquiry into the company’s activities.

Arrests and Ongoing Investigations

Since the investigation began, authorities have made over 80 arrests, confiscating around $28 million (about HK$228 million) in assets. Notably, three alleged ringleaders still remain at large, prompting authorities to issue Interpol red notices for their capture.

Expert Insights

Joshua Chu, a legal expert and co-chair of the Hong Kong Web3 Association, emphasized that the case against JPEX is fairly straightforward due to Hong Kong’s strict anti-money laundering laws, particularly section 53ZRG. He highlighted the liability that influencers, or KOLs, face for promoting JPEX while disregarding the SFC’s warnings against the platform’s trustworthiness.

Following his release on bail, Lam conducted a press conference indicating that he had been sleeping well, a statement that sparked criticism for its apparent lack of empathy towards the fraud victims. Chu commented that such public indifference could affect the court’s perception of Lam during legal proceedings and sentencing, potentially diminishing any chances of leniency.

Furthermore, Chu pointed out that Lam’s legal strategies have been detrimental, as they did not leverage opportunities for productive engagement with authorities prior to the formal charges being filed. This inaction has hindered potential remedies for the victims of the fraud.

Future Implications

Nevertheless, the JPEX scandal is likely just the beginning, with ongoing investigations suggesting a more intricate web of transactions and accomplices. For victims hoping to recuperate their losses, recovery efforts will need to focus on tracing asset flows rather than relying solely on the outcomes of criminal convictions, with the most viable pathway for compensation tied to reclaiming assets directly linked to the main platform rather than those dispersed across various KOLs and indirect holdings.