Introduction

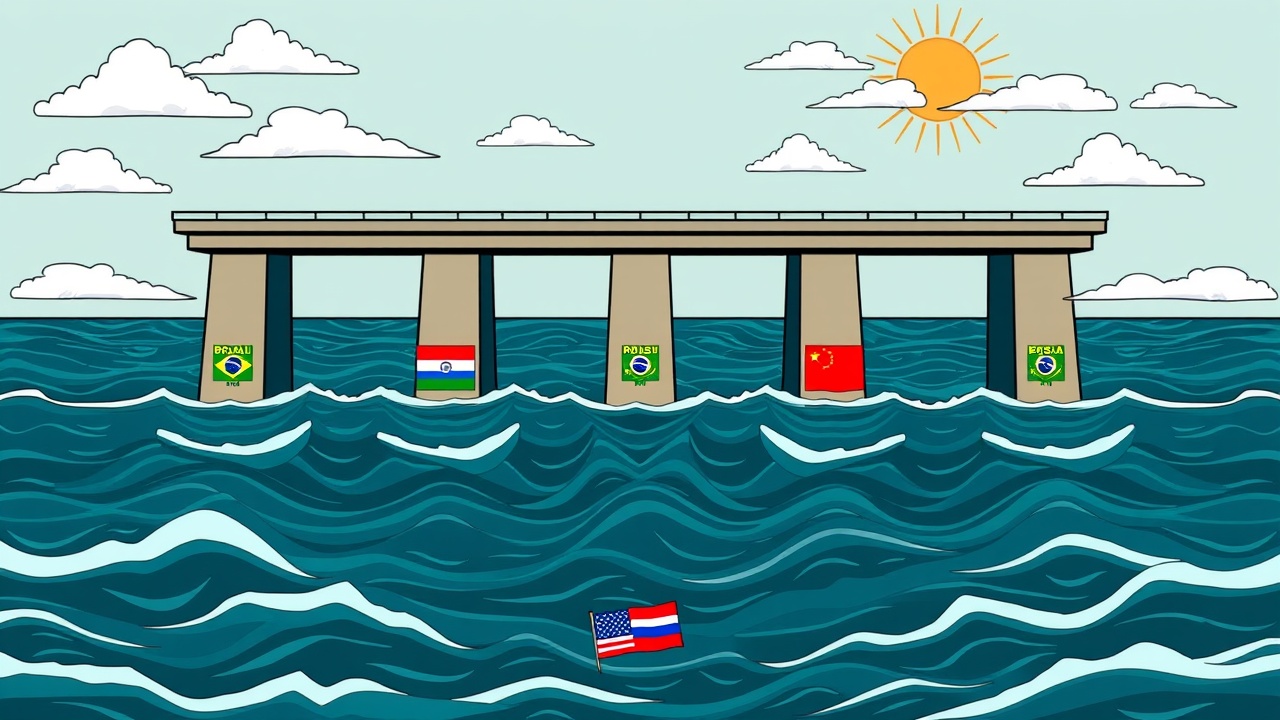

The Reserve Bank of India (RBI) is advocating for a collaborative effort among BRICS nations to link their central bank digital currencies (CBDCs) by the year 2026. This initiative aims to facilitate trade and tourism by creating a common settlement mechanism that operates independently of the dollar-centric financial systems.

Unified Digital Currency Framework

According to a report from Reuters, this proposal emphasizes the importance of a unified digital currency framework, integrating India’s e-rupee with China’s digital yuan and currencies from other BRICS member states.

Government Prioritization

RBI officials have urged the Indian government to prioritize this initiative during the upcoming 2026 BRICS summit, which India is set to host later this year. If this proposal gains traction, it would represent a significant first step towards a coordinated approach to digital currencies at a sovereign level, allowing for easier and more efficient transactions between member nations.

Rationale Behind the Initiative

The rationale behind this move is the desire to decrease reliance on the U.S. dollar for international business dealings. By adopting local CBDCs for trade and tourism transactions, BRICS countries can potentially avoid using the traditional dollar-based banking systems, which often involve multiple intermediaries and incur higher costs and delays.

The RBI posits that a direct payment system using CBDCs would streamline processes, enhancing efficiency and cutting down expenses related to currency conversions.

Geopolitical Context

This initiative has emerged against the backdrop of rising geopolitical tensions, particularly in light of trade disputes and former U.S. President Donald Trump’s critical remarks about BRICS being “anti-American.” The RBI perceives the establishment of a shared CBDC framework as a safeguard enabling member nations to better insulate their economies and trade activities from external political challenges.

Technical Standards and Governance

To move forward, achieving consensus on the technical standards for interoperability and governance among BRICS nations will be essential, a task that has become more intricate with the inclusion of new members like the UAE, Iran, and Indonesia. Discussions have also touched on potential bilateral foreign-exchange mechanisms to help manage trade discrepancies among the nations involved.

Current Status of CBDCs

As of early 2026, the e-rupee has garnered about 7 million retail users in India, while China actively seeks to expand the global footprint of its digital yuan. Brazil, Russia, and South Africa are also piloting advanced CBDC projects, highlighting the growing interest in digital currencies within the bloc.

Conclusion

If the RBI’s plan is accepted at the upcoming summit, it could significantly alter the landscape of regional trade practices among emerging markets.