Introduction

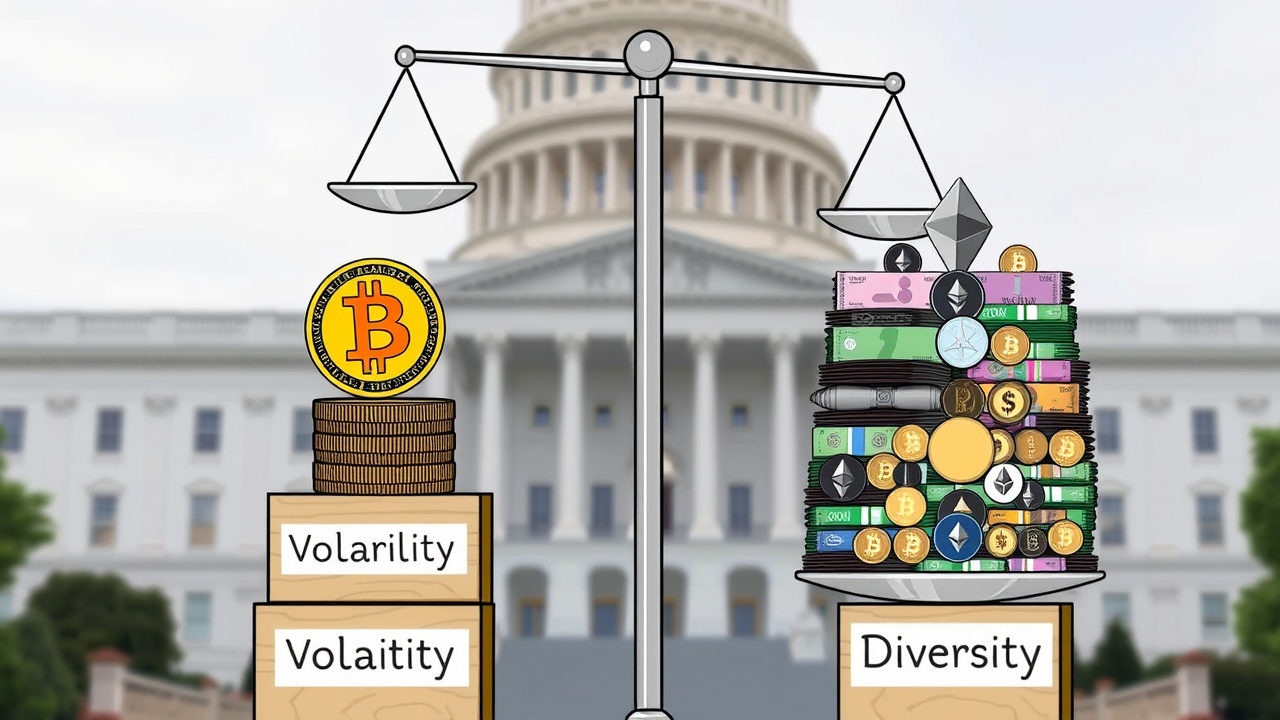

In an effort to broaden the scope of cryptocurrency legislation in Indiana, State Representative Kyle Pierce has introduced a bill aimed at supporting a variety of digital currencies, rather than just focusing on Bitcoin. The Republican lawmaker emphasized that his proposal is intentionally inclusive, steering clear of favoritism toward specific cryptocurrencies like Bitcoin or Ethereum.

“My intention is to nurture the entire cryptocurrency ecosystem instead of picking favorites,”

Pierce stated in an interview with Decrypt.

Bill Overview

The bill, which is still in its early stages, aims to facilitate investments by state public service programs into exchange-traded funds that offer exposure to cryptocurrencies through retirement and savings plans. Furthermore, it proposes the establishment of safeguards for both crypto users and businesses operating in the sector.

Comparative Approach

Unlike similar measures in states such as New Hampshire that allow direct government investment in digital assets while limiting such investments to those with a minimum market capitalization of $500 billion—an exclusivity only Bitcoin has ever achieved—Pierce’s legislation takes a more expansive approach.

Industry Engagement

During the development of his bill, Pierce engaged with various industry advocates, including the Satoshi Action Fund, which promotes policies beneficial to Bitcoin but is not involved with other cryptocurrencies. The Fund takes pride in having policies enacted in eight different states, reflecting a growing movement towards favorable digital currency legislation.

Market-Cap Considerations

Although there had been considerations of imposing a market-cap requirement for qualifying cryptocurrencies, Pierce ultimately decided against it, warning that not all digital currencies should be deemed suitable for public sector investment. He expressed concern over the sustainability of newer cryptocurrencies, highlighting the distinction between established currencies and less proven ones.

“If a cryptocurrency was just launched recently, it might not be prudent to include it in retirement investment plans,”

he noted, hinting at possible revisions in the future.

Protection for Miners

Additionally, the bill includes provisions aimed at protecting cryptocurrency miners, who face scrutiny due to the high energy consumption associated with securing networks like Bitcoin. Pierce assured that while these miners will not receive preferential treatment, the legislation ensures they won’t be unfairly targeted by regulatory actions.

Legislative Context

Pierce’s efforts have gained traction following the recent passage of stablecoin legislation at the federal level, particularly with the signing of the GENIUS Act by former President Trump in July. He remarked that this shift has fostered greater trust in the legislative process around cryptocurrencies.

“There doesn’t appear to be substantial opposition to my bill at this point, which is promising, although I remain cautious about its passage,”

he concluded.