Class Action Lawsuit Against Benjamin Chow

In a recent class action lawsuit, Benjamin Chow, the founder of Meteora, has been accused of orchestrating a fraudulent scheme involving meme coins, particularly the well-known LIBRA and MELANIA tokens. This legal action arises from the case of Hurlock v. Kelsier Ventures, where Chow and several other defendants are implicated.

Allegations Against Public Figures

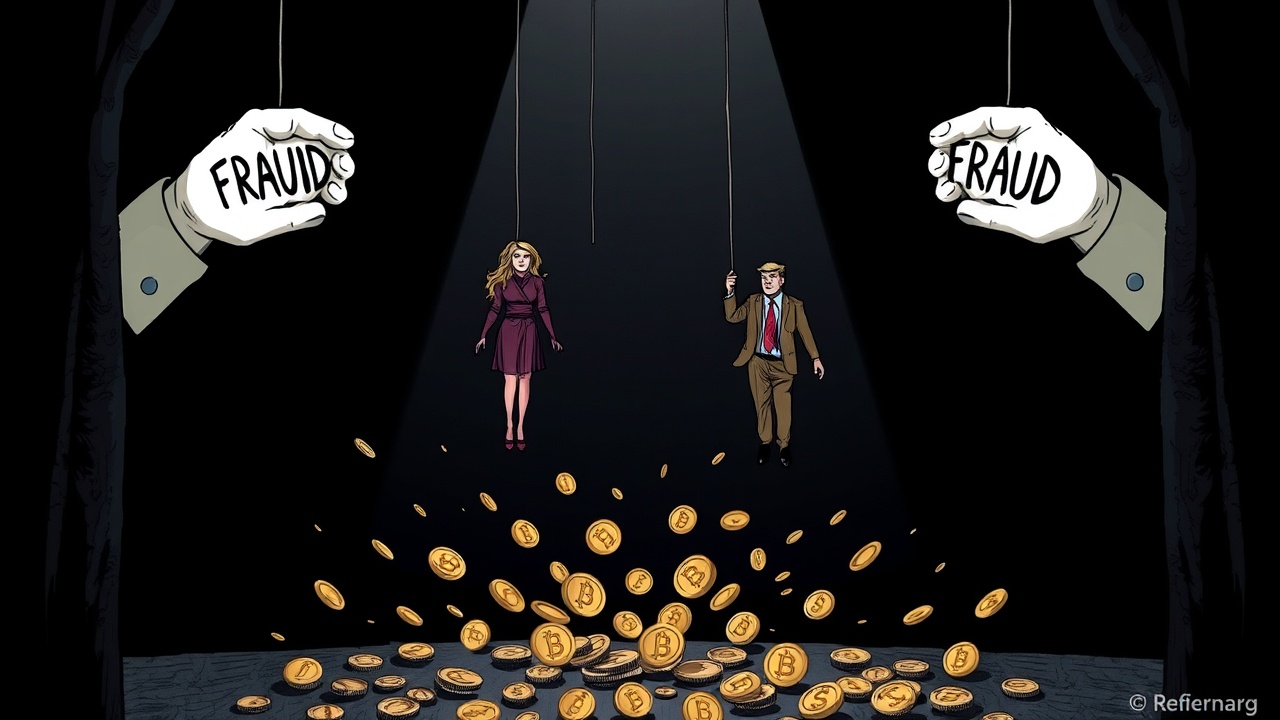

Notably, the lawsuit contends that the public figures who endorsed these tokens—First Lady Melania Trump and Argentine President Javier Milei—should not bear responsibility for the alleged misconduct regarding these coins, described as scams by the plaintiffs.

According to the complaint, which highlights the issuance of five tokens, the MELANIA and LIBRA coins were uniquely tied to the credibility of their namesakes, leveraging their reputations to create a sense of legitimacy around what was, in essence, a “liquidity trap.” The document states that these well-known personalities were used merely as decorative elements in a scheme crafted by Chow and his associates.

“Plaintiffs do not allege those public figures were culpable; they were merely the window dressing for a crime engineered by Meteora and Kelsier,”

it notes.

Token Performance and Fallout

In January, shortly after President Trump launched his official token, Melania Trump promoted the coin named after her. Initially, this token experienced a meteoric rise in value but subsequently plummeted by 99% as the creators began to sell off their holdings indiscriminately. Similarly, President Milei’s promotion of the LIBRA token, which was intended to support small businesses in Argentina, also ended in disaster as it skyrocketed before dropping by 90% within hours, leading Milei to retract his endorsements.

Investigations and Findings

Investigations by on-chain analytics firm Bubblemaps established connections between the wallets responsible for the MELANIA and LIBRA tokens, which ultimately contributed to the class action lawsuit. The plaintiffs argue that Chow played a pivotal role in the operation, describing him as “at the center of the enterprise.” They assert that Meteora’s automated market maker business functioned independently from Chow’s framework responsible for launching so-called “pump-and-dump” schemes under the Meteora label.

Key Players in the Scheme

The lawsuit implicates Chow as having worked closely with a select group of partners, including Ng Ming Yeow (referred to as Ming) and the Davis brothers of Kelsier Ventures, in orchestrating these fraudulent activities. The complaint specifies that they successfully launched at least 15 tokens following a similar strategy. Amidst this turmoil, Hayden Davis, the CEO of Kelsier Ventures, became a focal point after publicly addressing the fallout from the LIBRA collapse, with the lawsuit alleging that he acted under Chow’s directive during these token launches.

Chow’s Departure and Legal Proceedings

After scrutiny of the meme coin ventures began, Chow stepped down from Meteora in February. As the plaintiffs maintain their claims, they point to private messages from Davis, which they interpret as evidence of Chow’s control over the operation. Interestingly, a judge recently ruled to unfreeze $57.6 million in USDC tied to the LIBRA coin, expressing doubts about the plaintiffs’ chances of succeeding in their lawsuit. Kelsier Ventures has yet to respond to requests for commentary on this ongoing situation.