Paul Graham Critiques SEC’s Approach to Cryptocurrency

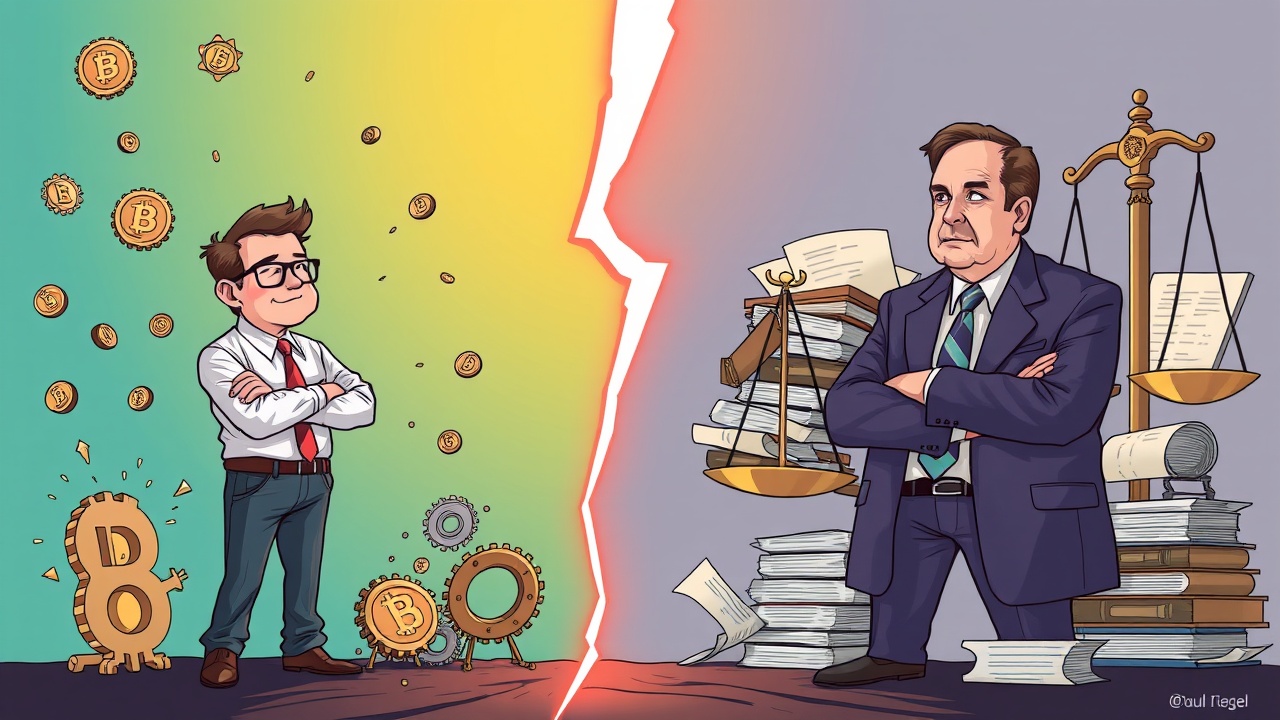

Paul Graham, co-founder of Y Combinator, has voiced strong criticism regarding the previous U.S. Securities and Exchange Commission (SEC) leadership under Gary Gensler, suggesting that their approach to cryptocurrency regulation was flawed. Graham believes that the crypto sector has long been seeking clarity in regulations, yet was consistently met with ambiguity from the SEC.

“I disagree with these people, but I have to point out that they wanted crypto regulated, not deregulated.”

Graham’s frustration stems from the SEC’s unwillingness to establish clear guidelines on the legal classification of digital assets, which he characterized as “appallingly irresponsible” and an “attack” on legitimate players in the industry. He pointed out that while regulatory bodies were pursuing lawsuits against established crypto exchanges like Coinbase, those truly engaging in fraudulent practices, such as the scandal-ridden FTX, ultimately faced little consequence, as they operated outside the bounds of regulatory compliance.

New Leadership and Regulatory Changes

In a pivot from the prior administration’s stance, Paul Atkins, who has recently taken over as the SEC’s chair, has initiated “Project Crypto”. This initiative seeks to reshape the regulatory landscape by arguing that the majority of crypto tokens do not qualify as securities—a shift from Gensler’s earlier doctrine. Under Atkins’ leadership, the SEC has also chosen to dismiss or settle significant enforcement actions against notable platforms including Coinbase, Kraken, and Ripple, suggesting a more conciliatory approach to digital assets by avoiding litigation as a primary means of regulatory oversight.

Resistance to New Strategies

However, Atkins’s new strategy has faced resistance, particularly among Democratic lawmakers, signaling a potential rift within regulatory and policy circles about the future of cryptocurrency oversight in the United States.