Recent Developments in the FTX Legal Battle

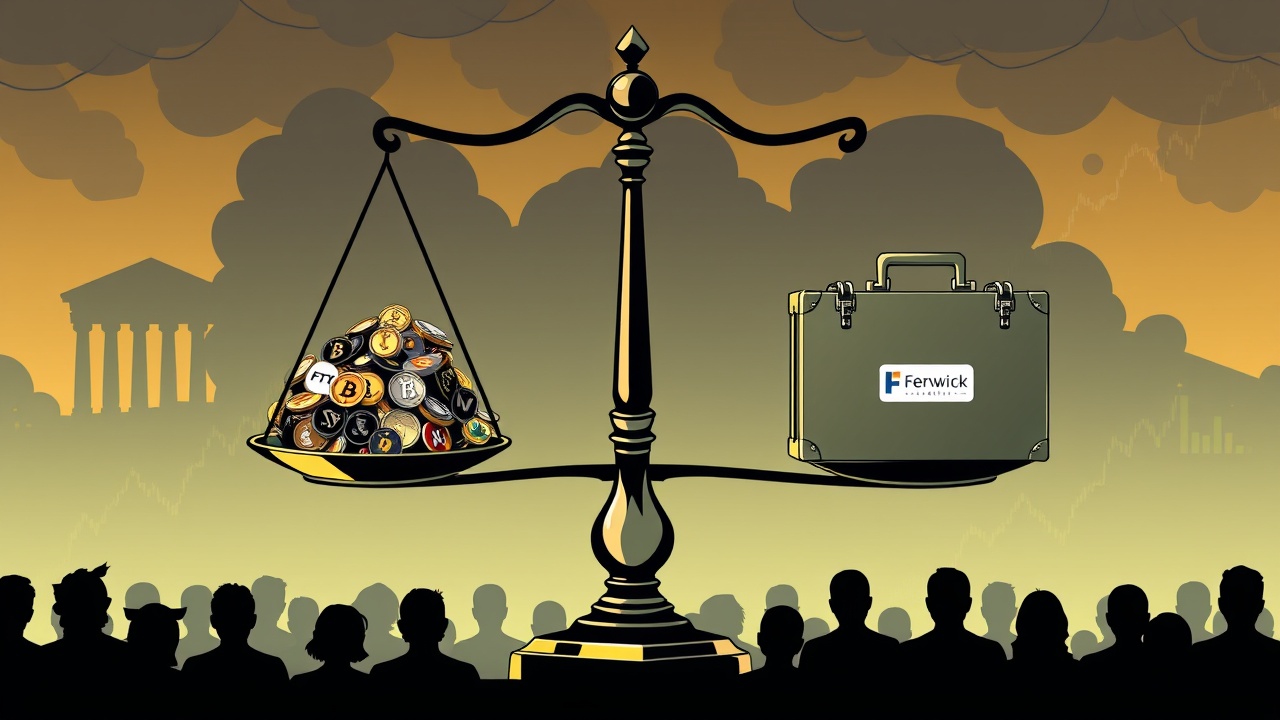

Recent developments in the legal battle surrounding the collapse of FTX have revealed that Fenwick & West, a law firm, may be approaching a resolution with users of the disgraced crypto exchange. A proposed class-action settlement has been put forth to a federal court in Florida, as filed by both FTX users and the firm. The formal request for approval of this settlement is anticipated to be submitted on February 27, though specific terms of the agreement remain undisclosed. In light of the proposed settlement, both parties have requested a temporary halt to existing court deadlines and motions pertaining to this case.

Allegations Against Fenwick & West

The allegations against Fenwick & West originated from a lawsuit filed in 2023 and enlarged in August to become part of a broader multidistrict litigation concerning the downfall of the FTX exchange in late 2022. This litigation has implicated numerous parties, including former executives, celebrity endorsers, and service providers who were associated with FTX. The core claim from FTX users alleged that Fenwick played an instrumental role in supporting the fraudulent activities occurring at the exchange, specifically by offering legal strategies that enabled misconduct without detection.

The plaintiffs stated that Fenwick’s legal advice contributed significantly to FTX’s operational framework, which reportedly allowed the intertwining of customer funds with the firm’s own finances and circumvented necessary regulatory registrations.

Fenwick & West’s Defense

Fenwick & West has consistently denied these allegations, arguing in court that they acted within legal bounds and had no involvement in any fraudulent activities. They sought to have the lawsuit dismissed, asserting that their services were standard legal procedures and that they had no awareness of any wrongdoing taking place at FTX. Nevertheless, in November, the court denied this request and permitted the case to move forward, motivating the involved parties to consider a potential settlement.

Regulatory Concerns Surrounding Cryptocurrency

In parallel, the discussion around U.S. regulations for cryptocurrency has intensified, especially as New York prosecutors raised alarms regarding the GENIUS Act, a new bill focused on stablecoins. Concerns were articulated in a letter signed by New York Attorney General Letitia James along with four district attorneys, claiming that the legislation could potentially undermine protections for fraud victims. They emphasized that the GENIUS Act may grant significant leeway to prominent stablecoin companies, including Tether and Circle, essentially allowing them to evade accountability for preventing the recovery of illicitly obtained funds.

The prosecutors accused Tether of insufficient action regarding suspicious transactions and claimed its practices may hinder attempts to aid victims of fraud. Additionally, they criticized Circle for not representing itself transparently in its efforts against financial crime and described its victim recovery policies as less effective than those of Tether.

In response to these critiques, both Tether and Circle defended their operations, with Circle highlighting its compliance with U.S. regulations and commitment to financial integrity, and Tether asserting its vigilance against illicit activities and claiming that it operates outside of U.S. jurisdiction from its base in El Salvador.

Conclusion

Should the settlement with Fenwick & West be approved, it would mark a significant step in untangling the complicated legal landscape involving FTX and its associates, moving one less defendant out from the extensive litigation surrounding the exchange’s failure.