South Korea’s Regulatory Landscape for Stablecoins

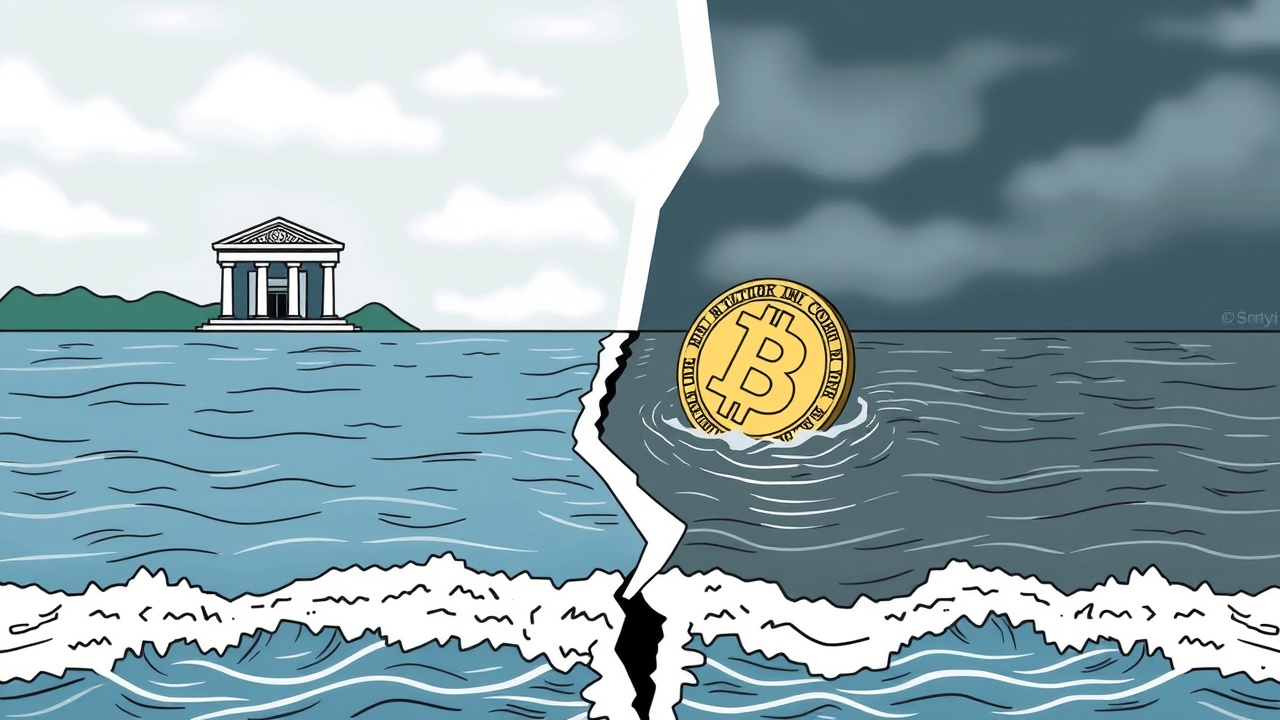

As the year comes to a close, South Korea is set to lack a regulatory structure for the issuance of domestic stablecoins, primarily due to ongoing disputes surrounding the role of banks in this process. The Bank of Korea (BOK), alongside various financial regulatory bodies, has engaged in disagreements regarding the necessary involvement of banks in the issuance of stablecoins tied to the Korean won. This discord has resulted in delays for a framework that many anticipated would be established by late 2025, as reported by Korea JoongAng Daily.

Current Regulatory Stance

Currently, the BOK’s position mandates that any issuer wanting regulatory approval for a won-backed stablecoin must be predominantly owned—at least 51%—by a group of banks. In contrast, financial regulators display a more liberal stance, supporting a broader mix of industry participants. An official from the BOK stated that banks, due to their regulatory oversight and proficiency in anti-money laundering procedures, are ideally suited to hold a majority stake in these stablecoin enterprises.

Concerns Over Non-Bank Issuance

The BOK argues that entrusting banks with the primary responsibility of stablecoin issuance would significantly lower risks associated with both financial stability and foreign exchange. Releasing the reins to non-banking entities for stablecoin issuance could challenge existing regulations that prohibit industrial companies from owning banks, since stablecoins act similarly to deposit accounts by gathering consumer funds. The BOK highlighted the potential pitfalls, likening non-bank issuance of stablecoins to allowing firms to engage in narrow banking operations—issuing currency while also providing payment services. Furthermore, they expressed concerns about technology firms possibly monopolizing stablecoin markets.

Legislative Developments

In an effort to establish a legal framework, the Financial Services Commission (FSC) was set to unveil proposals for regulating won-backed stablecoins as part of legislation anticipated for introduction in October. Current developments reveal that the National Assembly’s Political Affairs Committee is examining three bills relating to stablecoin issuance, presented by members of both the ruling Democratic Party of Korea and the opposition People Power Party. Among these proposals is a stipulation for a minimum capital requirement of 5 billion won (approximately $3.4 million), creating debate over whether stablecoin issuers should be permitted to generate interest on held amounts.

Ongoing Discourse and Industry Response

Lawmakers continue to show divisions, with varying viewpoints on interest payments; one proposal permits them while two others seek to impose restrictions. Meanwhile, as the discourse on the regulatory framework stretches on, South Korean tech giants are expediting their own stablecoin ventures. Notably, Naver Financial is preparing to launch a stablecoin wallet next month, in collaboration with Hashed and the Busan Digital Exchange. The BOK’s advocacy for a banking-led approach in stablecoin issuance reaffirms its previously expressed intentions, further echoed by Deputy Governor Ryoo Sangdai’s call for banks to be the primary issuers by mid-2025. Recently, several prominent South Korean banks, including KB Kookmin and Shinhan, have reportedly joined forces to create a won-pegged stablecoin set for a 2026 launch.