Ripple Advocates for Regulatory Changes in the UK Cryptocurrency Sector

In a bid to position the United Kingdom as a frontrunner in the cryptocurrency sector, Ripple is advocating for swift regulatory changes that promise to drive innovation and attract significant investment. During the London Policy Summit—organized by Ripple in collaboration with the UK Centre for Blockchain Technology and Innovate Finance—notable experts gathered to assess the government’s current initiatives aimed at establishing a robust framework for digital assets.

Ripple disclosed its findings on June 18, highlighting the progression of the UK’s regulatory landscape in the wake of proactive measures shared by Chancellor Rachel Reeves earlier this year. These include HM Treasury’s proposed legislation and the Financial Conduct Authority’s (FCA) ongoing consultations focused on stablecoins, custody issues, and oversight matters.

Advancements in the Cryptocurrency Sector

Moreover, Ripple pointed to exciting advancements in the sector, such as the introduction of new entities into the Digital Securities Sandbox, and the inception of a pilot program for a digital UK government bond called DIGIT.

Key Proposals from Ripple

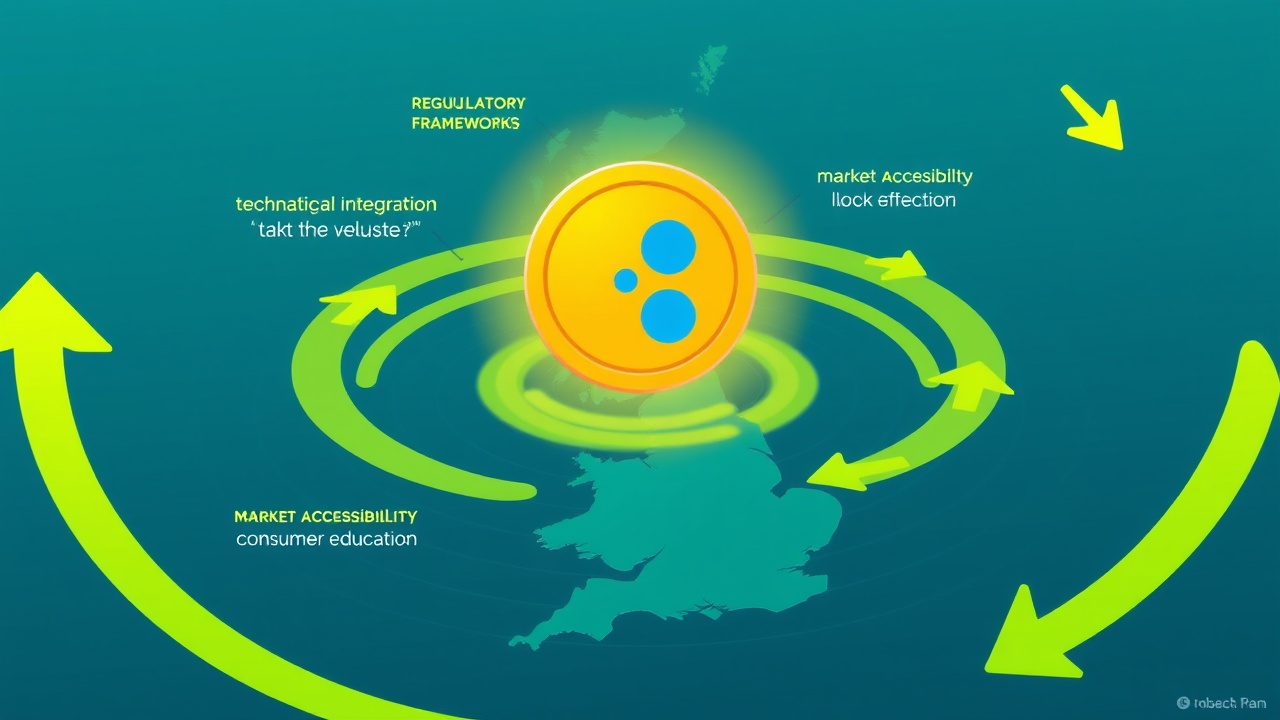

In a comprehensive whitepaper released post-summit, Ripple delineated four key proposals aimed at intensifying the UK’s development in the cryptocurrency arena. Firstly, it stressed the necessity of expediting the establishment of a regulatory framework that not only facilitates investment but also fosters growth within the sector. Ripple articulated,

“To harness opportunities for early adopters and advocates of digital assets, rapid action from the government and regulators is required.”

Secondly, Ripple advocates for UK regulations to be harmonized with international standards to avoid conflicting legal obligations. The third recommendation is to expedite the regulation of stablecoins, enabling foreign-issued variants to be utilized within the UK without the need for local issuance. Lastly, Ripple underscored the importance of implementing a revolutionary strategy aimed at addressing existing legal, regulatory, and tax challenges, thereby reinforcing the UK’s standing in tokenization.

The Future of Cryptocurrency in the UK

Highlighting the significant potential, Ripple warned that the proper regulatory design could pave the way for unprecedented innovation, greater financial inclusion, and the enhancement of the UK’s reputation as a competitive global financial hub. The company stressed the essential role of blockchain technology in modernizing payment systems, expanding financial access, and boosting transparency.

With projections indicating that over 90% of major global financial institutions will be involved in crypto-assets by 2024, Ripple and other summit contributors affirmed the necessity for rapid regulatory advancements to ensure that the UK can harness the escalating market demand and maintain its competitive edge on the world stage.