Ripple Labs Calls for Reconsideration of Cryptocurrency Legislation

Ripple Labs has called on the United States Senate to reconsider the recently proposed cryptocurrency legislation, stating that the current version creates confusion instead of clarity. The blockchain company expressed its opinions on August 5 in response to the Senate’s invitation for feedback on the draft of the Responsible Financial Innovation Act of 2025, published on July 22. This bill aims to enhance oversight of cryptocurrency by broadening regulatory mechanisms, boosting consumer protections, and clarifying the classification of digital assets.

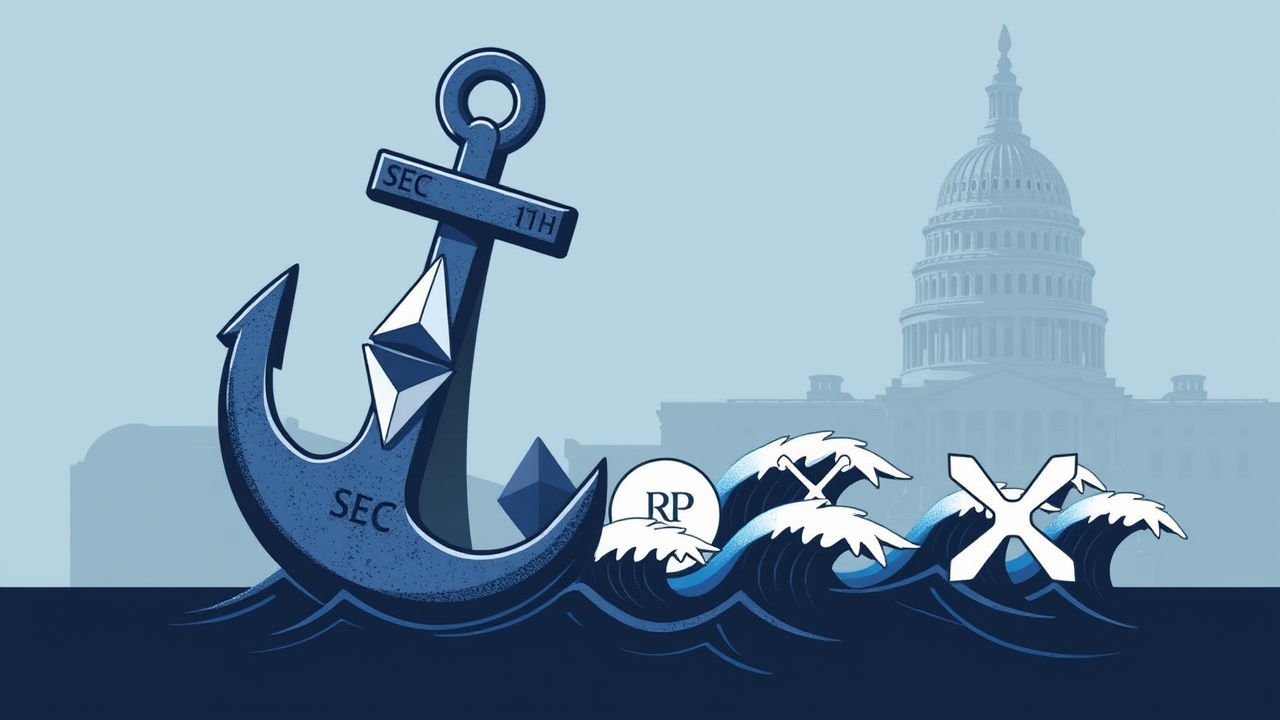

Concerns Over SEC Jurisdiction

Among Ripple’s significant concerns is how the bill addresses the concept of ‘ancillary assets’, which could lead to many digital currencies falling under the jurisdiction of the Securities and Exchange Commission (SEC). Ripple has warned that such a broad interpretation might invite future SEC administrations to apply the regulations in an overly flexible manner, thereby imposing limits on the expansion of the crypto sector. The firm highlighted that this could place well-established and actively traded tokens, such as Ethereum (ETH), Solana (SOL), and XRP, under ongoing SEC jurisdiction, even in instances where current or future transactions do not exhibit characteristics of a securities offering.

Ripple further contended that tokens linked to previous investment contracts should not remain indefinitely under SEC authority. The company advocates for the SEC’s jurisdiction to apply only to the specific transaction at hand, rather than extending it to all future dealings involving the asset. Ripple criticized the draft’s approach, suggesting it allows SEC jurisdiction based on previous actions that may not pertain to the current transaction, or may contravene essential legal protections.

Proposals for Legislative Clarity

In light of these concerns, Ripple proposed a definitive time limit on SEC jurisdiction concerning tokens initially sold as investment contracts. Additionally, the company urged lawmakers to clarify the Howey Test‘s application—a legal standard for determining whether an asset qualifies as a security—to ensure its uniform application and prevent subjective interpretations that could jeopardize market stability. They emphasized that if Congress seeks to incorporate the Howey Test into law, it must safeguard against potential misuse or manipulation by the SEC.

Beyond issues of SEC authority, Ripple implored legislators to offer clear parameters regarding which blockchain-related activities—such as staking, mining, and governance—should be categorized as securities. The firm believes that ambiguous regulations surrounding these areas could stifle innovation and impede wider adoption of blockchain technology. Ripple suggested that to prevent the improper application of the Howey Test, it should be distinctly stated that ‘entrepreneurial or managerial efforts’ do not encompass basic network functions or routine operational services.

Support for Token Protection Measures

In addition, Ripple expressed support for a provision within the bill that could safeguard tokens that have been actively traded for a minimum of five years, which they feel could shield them from retroactive enforcement actions. This measure, according to Ripple, would foster greater predictability and stability for established digital assets and enable the industry to progress with greater confidence.