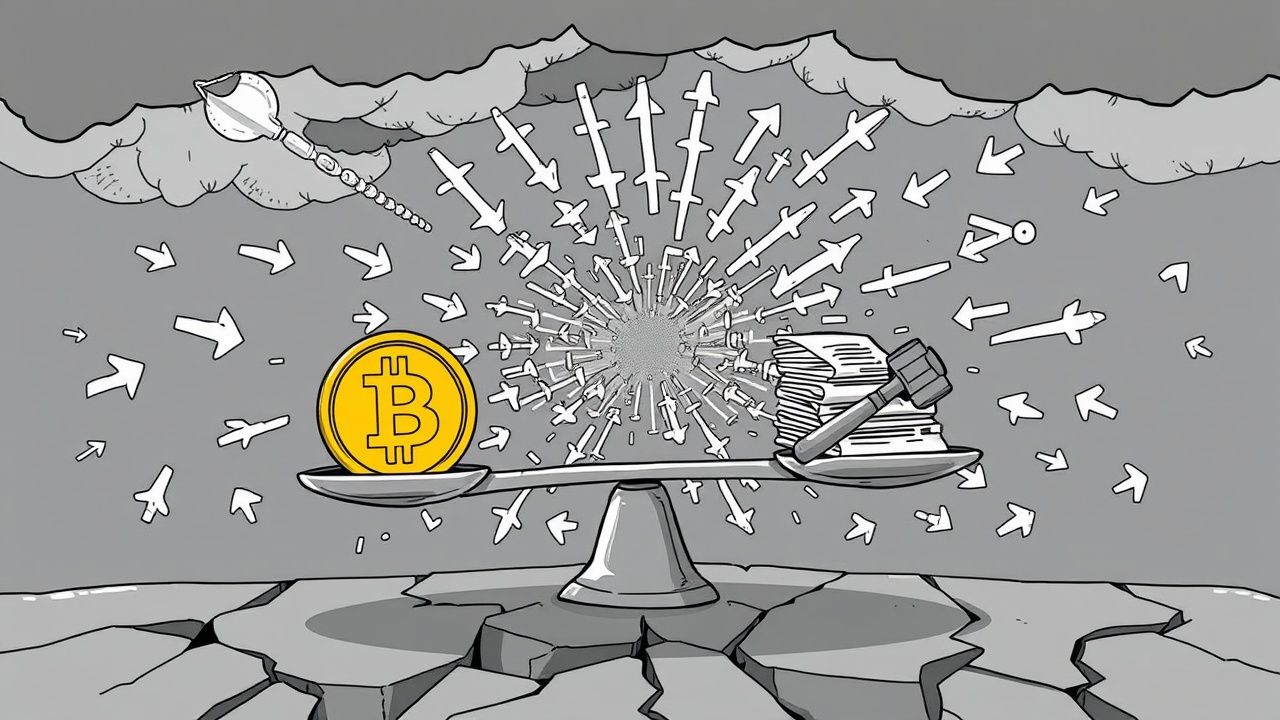

Cryptocurrency Regulation in the United States

The landscape of cryptocurrency regulation in the United States is currently muddied by contradictory directives from the Securities and Exchange Commission (SEC). Recently, SEC Commissioner Caroline A. Crenshaw publicly criticized the agency for its inconsistent stance on digital assets, particularly in her comments issued on May 31. Crenshaw’s remarks come at a critical time when the SEC’s Crypto Task Force is purportedly working to foster clearer guidelines for regulating crypto assets.

Concerns About Digital Asset Classification

In her statement, Crenshaw expressed alarm over what she perceives as growing confusion within the SEC regarding how to classify certain digital tokens, notably ethereum (ETH) and solana (SOL). Despite previous assertions made by SEC staff earlier in 2025—declaring that a variety of digital currencies, including meme coins, proof-of-work tokens, and stablecoins, do not qualify as securities—the recent approval of new exchange-traded funds (ETFs) has raised additional questions. These funds are operating under the Investment Company Act of 1940, suggesting that ETH and SOL might be considered securities after all.

“In the name of this clarity, we’ve seen staff statement after staff statement, pronouncing that all sorts of crypto assets are not securities. And yet, now we see no objection to the effectiveness of new exchange-traded funds that assert certain crypto assets—ETH and SOL—actually are securities.”

She called into question the SEC’s handling of these assets, highlighting a dissonance that allows different regulatory interpretations based on varying contexts:

“How is it that these crypto assets are supposedly not securities when it comes to registration requirements, but conveniently are securities when a registrant sees an opportunity to sell a new product?”

Calls for a Coherent Framework

The commissioner underscored her belief that the SEC is failing to ensure a stable regulatory environment, instead adopting a strategy that seems to encourage aggressive expansion into the crypto market, contrary to established legal standards. In her closing remarks, Crenshaw warned that the agency’s efforts toward clarity have only led to further confusion, referring to the situation as “muddy waters of our own making.”

Amid these discordant voices, Commissioner Hester M. Peirce has rallied support for digital currencies, suggesting that many of the crypto assets currently available in the market do not meet the criteria for being classified as securities. As the debate continues, the future of digital asset regulation remains uncertain, with stakeholders calling for a more coherent and consistent framework.