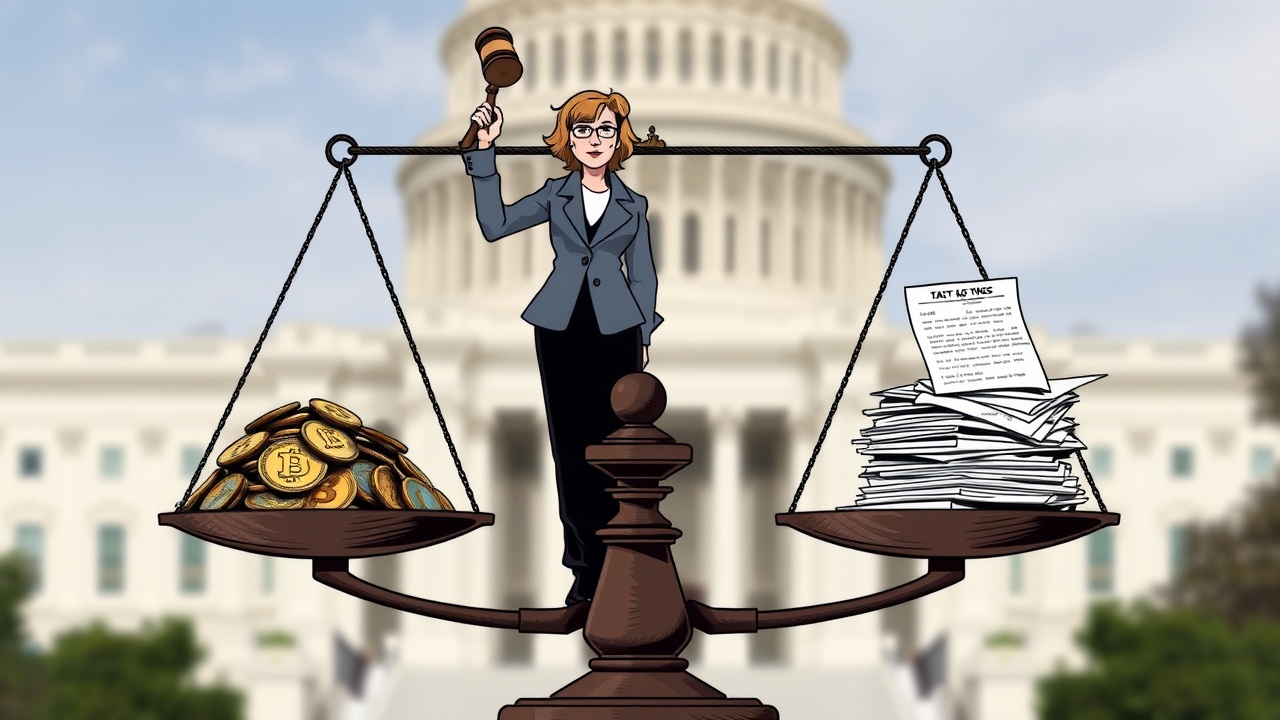

Cynthia Lummis Advocates for Crypto Tax Reform

In recent statements, Wyoming Senator Cynthia Lummis has advocated for a revamp of the tax framework surrounding cryptocurrencies, indicating that current policies have inadvertently placed Bitcoin and other digital assets at a disadvantage. On June 10, Lummis expressed her concerns via a post on platform X, arguing that outdated regulations need to be revisited to alleviate the burdens faced by the crypto sector.

The Role of the “Crypto Queen” in Legislation

Dubbed the “Crypto Queen” in Congress, Lummis has emerged as a prominent voice for cryptocurrency legislation, particularly through her introduction of the BITCOIN Act. This bill aims to institutionalize a federal Bitcoin reserve, building on former President Donald Trump’s executive orders. During her address at the 2025 Bitcoin Conference, Lummis unveiled her vision for a new crypto tax framework, stating that her office has already submitted a detailed proposal to the Senate Finance Committee.

Reassessment of Current Tax Definitions

In a letter dated May 12, both Lummis and colleague Bernie Moreno reached out to Treasury Secretary Scott Bessent, urging him to reassess the existing U.S. definition of “adjusted financial statement income.” They highlighted the Treasury’s capacity to modify existing interpretations to alleviate tax burdens on digital asset firms, calling on Bessent to utilize this authority.

IRS Classification and Tax Implications

Currently, the Internal Revenue Service (IRS) categorizes cryptocurrencies as property, which results in capital gains tax for any profitable transactions. Profits from trades of assets held for less than a year are taxed at rates corresponding to ordinary income, ranging from 10% to 37%, depending on an individual’s tax bracket. Conversely, profits from assets held for over a year enjoy more favorable tax rates of 0%, 15%, or 20%, incentivizing long-term investment in digital currencies.

The Future of Crypto Taxation

As stakeholders from both the legislative and financial sectors deliberate on cryptocurrency taxation, there is a consensus on the necessity for clearer and more equitable policies that keep pace with the rapidly evolving digital asset landscape. The adaptation of tax structures is crucial not only for encouraging innovation but also for ensuring fair compliance among participants in the burgeoning digital economy.

The discussions surrounding these tax reforms will play a critical role in shaping the future of investments and business practices within the crypto sphere in the United States, making it imperative for industry players to stay actively involved in the legislative dialogue.