Introduction

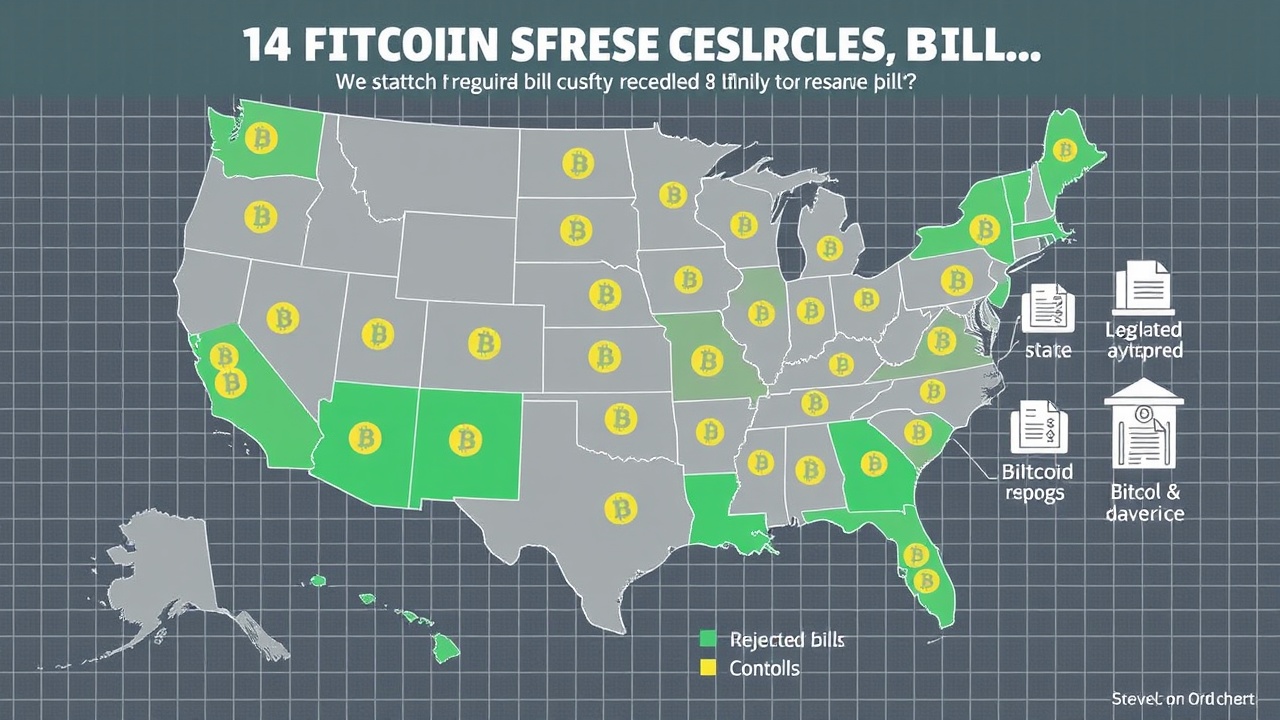

Amid a surge of interest in Bitcoin, sparked by various companies acquiring cryptocurrency and former President Donald Trump advocating for a national crypto stockpile, multiple U.S. states are taking action to pass legislation enabling their own Bitcoin reserves. As reported by Bitcoin Reserve Monitor, three states have successfully enacted such laws, while five have voted against them. Currently, 17 additional states are contemplating similar measures.

States Considering Bitcoin Reserves

The states still debating include Alabama, Florida, Georgia, Idaho, Illinois, Kansas, Kentucky, Maine, Maryland, Michigan, Missouri, New Mexico, North Carolina, Ohio, Oklahoma, Rhode Island, and West Virginia.

Legislative Frameworks

The definitions and frameworks for what constitutes a “Bitcoin reserve” differ from state to state. Some legislative proposals aim to directly acquire Bitcoin on the market, whereas others focus on retaining digital assets that originate from law enforcement actions or asset forfeiture. Although many bills are theoretically open to a variety of cryptocurrencies, in practice, stringent market capitalization criteria typically favor Bitcoin as the only suitable asset.

State Initiatives

New Hampshire‘s pioneering move came in early May with the enactment of HB 302, which allows the state to invest up to 5% of public funds in both precious metals and digital assets—provided they maintain an average market cap of over $500 billion for the previous year. Governor Kelly Ayotte hailed this as a testament to the state’s forward-thinking approach, celebrating the adoption with a post on social media.

Conversely, Arizona‘s journey in the realm of Bitcoin reserves has been fraught with legislative obstacles. In May 2025, the state updated its unclaimed property laws through HB 2749, facilitating the retention of crypto assets without the requirement of liquidating them. This change aimed to enable Arizona to hold confiscated Bitcoin in reserve, but subsequent efforts to broaden the initiative faced significant pushback. Governor Katie Hobbs vetoed two bills, one that would have permitted state treasurers to allocate 10% of funds to digital assets and another aimed at creating a state-managed Bitcoin Reserve.

On the other hand, Texas has emerged as a leading adopter of Bitcoin reserve legislation. In June 2025, Governor Greg Abbott enacted laws that created the Texas Strategic Bitcoin Reserve, incorporating strong protections to prevent future legislative terms from dismantling it easily. Texas’s framework is inclusive of Bitcoin and other digital assets, provided they meet the stringent market cap of $500 billion over 24 months, further solidifying Bitcoin’s position as the primary asset in the reserve.

Challenges Faced by Other States

Attempts in other states to mirror these initiatives, however, have largely been stymied by political opposition and financial apprehensions. Montana, for instance, saw the introduction of House Bill 429, which aimed to allow an allocation of $50 million toward cryptocurrencies and precious metals, yet it ultimately failed to garner the required legislative backing. Similar efforts faced defeat in North Dakota, Pennsylvania, Wyoming, and South Dakota, while an ambitious blockchain bill in Utah was stripped of provisions that would sanction a Bitcoin reserve.

Lawmakers in these states have voiced concerns regarding the volatile nature of Bitcoin prices, the potential legal ramifications of such investments, and the long-term sustainability of cryptocurrencies as a reserve asset, contributing to the hesitance surrounding Bitcoin investment at the state level.