Taiwan’s Integration of Stablecoins

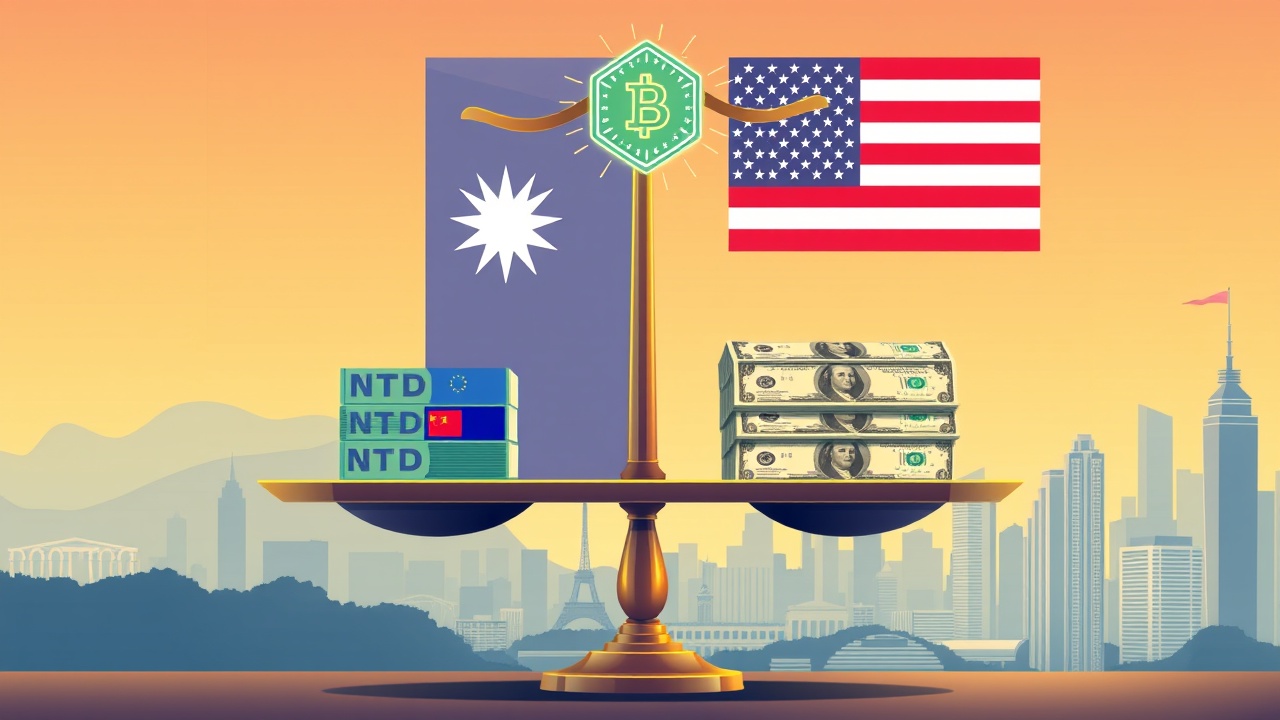

Taiwan is moving forward with integrating stablecoins into its banking framework, sparking significant discussions about whether these digital assets should be tied to the New Taiwan Dollar (NTD) or the U.S. dollar. This critical issue was highlighted during a forum hosted by the Taiwan External Trade Development Council on December 15, where regulators and industry leaders evaluated how stablecoins could reduce transaction fees for Taiwanese businesses engaged in international trade.

Current Challenges for Taiwanese Exporters

Currently, Taiwanese exporters are faced with international transaction costs upwards of 5%, which include outgoing wire transfers, incoming payment fees, and intermediary bank charges. Adopting a stablecoin linked to the U.S. dollar could potentially simplify cross-border transactions and help bypass certain regulatory obstacles related to the offshore circulation of NTDs. Conversely, using a token pegged to the NTD might offer a more integrated approach within Taiwan’s existing domestic payment systems.

Support for NTD-Linked Stablecoins

Alex Liu, the CEO of MaiCoin and a member of the Taiwan Virtual Asset Service Provider Association, supports the idea of a stablecoin tied to the local currency, stating it could bolster Taiwan’s economic growth.

Payment providers are closely observing developments in stablecoins, which are believed to promise substantial reductions in transaction fees, particularly in environments akin to conventional foreign exchange markets. Liu stressed that an NTD-linked stablecoin’s primary function would not be speculative trading, but rather enhancing efficiency and managing risks for businesses dealing with fluctuating currencies.

Market Volatility and Future Prospects

Recent volatility in currency markets, exacerbated by U.S. tariff announcements, has heightened exchange rate risks for exporters in Taiwan. Liu believes that stablecoins pegged to the NTD will soon establish themselves as standard payment methods, noting the currency is already functioning as a relatively stable asset backed by about $600 billion in U.S. dollar assets.

Taiwan’s Position in Global Digital Finance

Positioned as a potential leader in the global digital finance landscape, Taiwan’s stablecoin sector is described by Liu as a “dark horse.” The island’s capital markets have recently ascended into the top ten globally by market capitalization, now standing alongside countries like Switzerland and Germany, displaying remarkable performance relative to Taiwan’s size and economic capabilities.

Legislative Developments

In parallel, Taiwan is drafting its inaugural comprehensive legislation for stablecoins, known as the Virtual Asset Service Providers Act, which is under review by the Cabinet. Feedback from various government agencies will be collected before the Executive Yuan presents the legislation to the Legislative Yuan for formal consideration. Hsou-Yuan Chung, vice chairperson of Taiwan’s Financial Supervisory Commission, indicated that regulators are viewing stablecoins more as essential payment infrastructure rather than speculative tools, acknowledging their increasing significance in international transactions.