Transak Expands Licensing for Stablecoin Payments

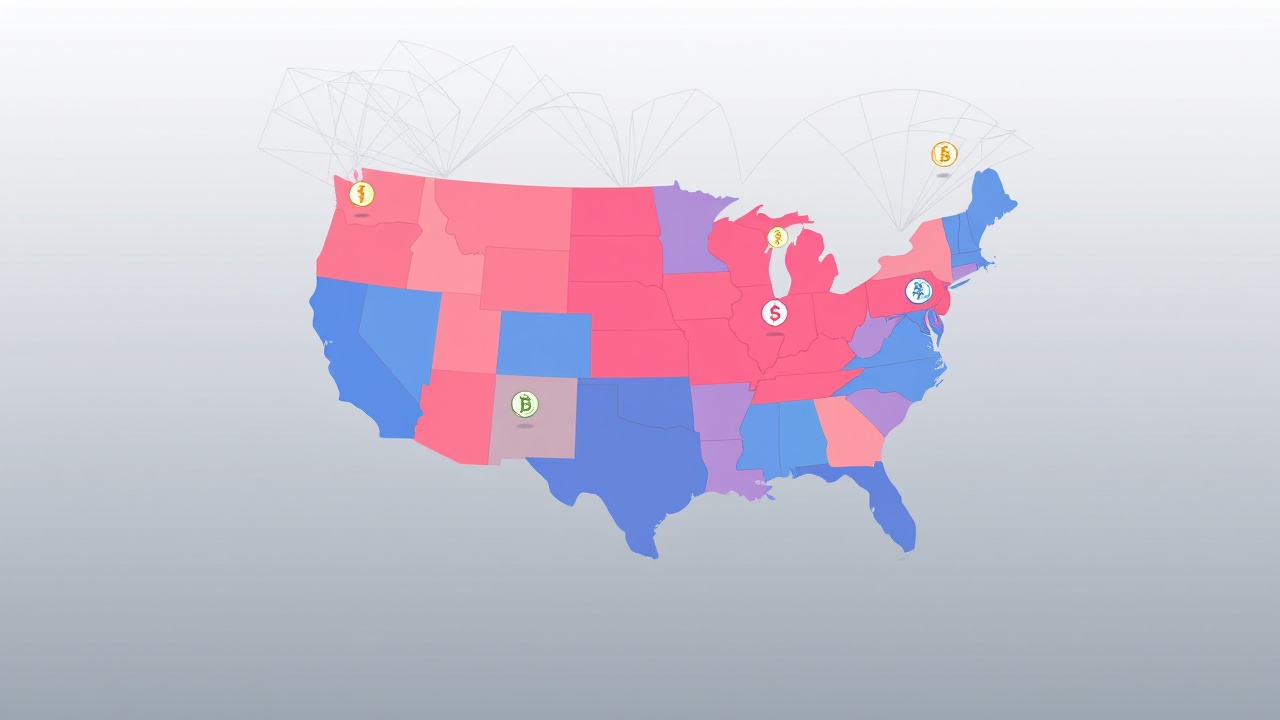

Transak, a company focused on facilitating stablecoin payments, has recently obtained Money Transmitter Licenses (MTLs) in six additional U.S. states: Iowa, Kansas, Michigan, South Carolina, Vermont, and Pennsylvania. This expansion, announced on Tuesday and reported by Cointelegraph, takes the total number of states where Transak is licensed to 11, adding to its existing licenses in Arkansas, Delaware, Illinois, and Missouri. These licenses empower Transak to process stablecoin transactions, transmit funds, and oversee fiat-to-crypto conversions directly with customers without needing third-party intermediaries.

Importance of Money Transmitter Licenses

In the United States, MTLs are essential for firms to manage customer assets, conduct monetary transfers, and operate as officially recognized financial intermediaries under state laws. Bryan Keane, Transak’s compliance officer for the Americas, noted:

“Every new license we secure brings us closer to a future where users can move between fiat and digital assets seamlessly and lawfully.”

Regulatory Landscape: U.S. vs. EU

The volatile regulatory environment in the U.S. sharply contrasts with that of the European Union, where the Markets in Crypto-Assets Regulation (MiCA) allows for a streamlined licensing system across all 27 member states. In the EU, a single crypto license allows a company to operate throughout the region without undergoing multiple regulatory approvals. Conversely, U.S. crypto payment providers are often burdened with the necessity of securing individual licenses for each state, a process that can involve navigating 50 distinct application procedures, each fraught with its own set of requirements, timelines, and associated costs. This complex patchwork can significantly hamper the efforts of companies aiming for nationwide reach.

Transak’s Regulatory Journey

Transak’s regulatory journey began in earnest in 2024 with its inaugural MTL in Alabama, which enabled it to function independently without third-party dependencies. Despite having partnerships that allow access in 46 states, Transak’s commitment to achieving full licensing represents a strategic move to create a fully regulated payments framework.

Regarding its recent licensing achievements, Keane emphasized that these steps are not merely about broadening reach, but rather about enhancing regulatory oversight, thus allowing the company more operational flexibility for forthcoming stablecoin applications and innovations in payment systems. He revealed that Transak currently has an additional 19 state licenses under review and aspires to secure full coverage across all states within the next year to year and a half.

Future Outlook and Innovations

Looking ahead to the potential regulation at the federal level, Keane expressed optimism about imminent federal legislation for stablecoins, which he believes would provide clearer guidelines that would benefit both users and infrastructure providers. He acknowledged that harmonizing federal and state regulations could take significant time. Nevertheless, Transak is focused on progressing within the existing state frameworks.

Additionally, on August 6, Transak made a notable advancement by becoming the first U.S. crypto on-ramp to facilitate wire transfers, thereby enabling users to fund their crypto accounts through this method. The company is also set to introduce Automated Clearing House (ACH) payments to further accelerate the bank transfer process for American users. With these new licenses, Transak aims to enhance stablecoin payment accessibility at scale and is actively pursuing more MTL applications to lay the groundwork for expansive nationwide stablecoin access. Their ongoing compliance efforts are geared toward enabling developers, businesses, and users to engage in future cross-border payments within a compliant framework.