Trump’s Potential Shift in Regulatory Appointments

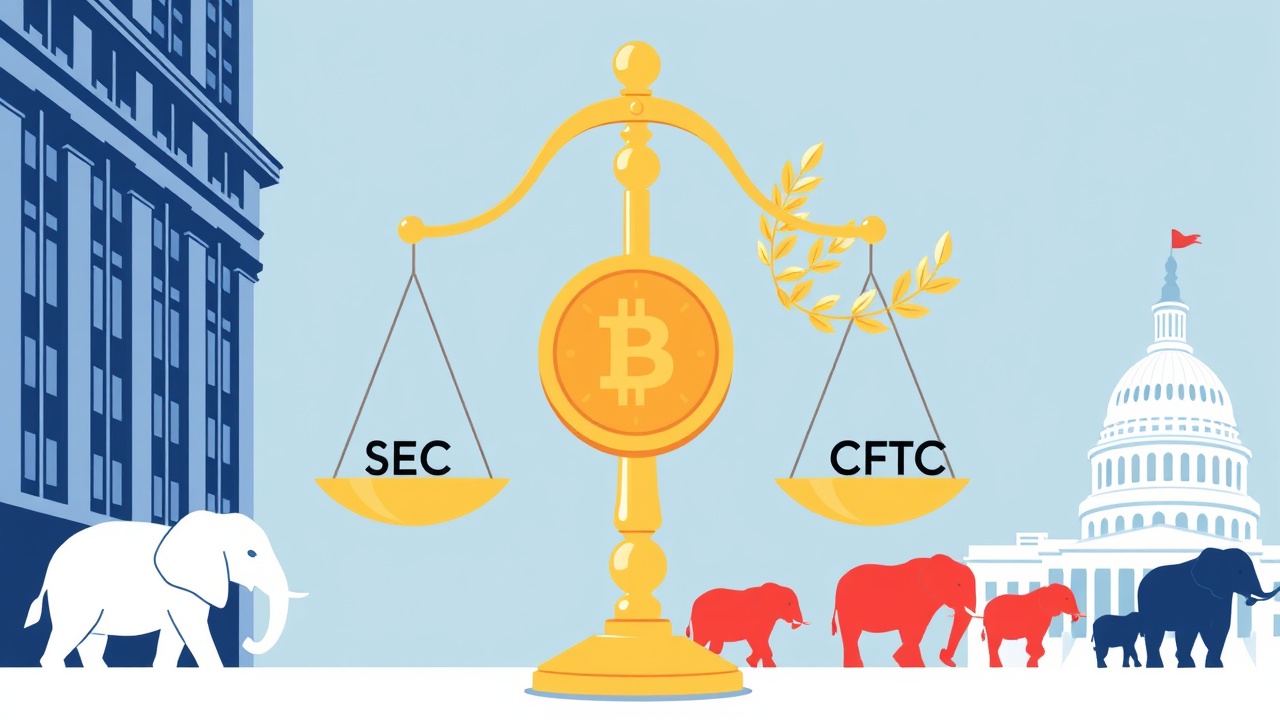

In a surprising shift, President Donald Trump indicated this week that he might consider nominating Democratic commissioners to fill vacancies at the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). This announcement could provide a much-needed boost to the prospects of the stalled crypto market structure legislation currently awaiting action in the Senate.

Trump’s Remarks on Bipartisanship

During a recent press briefing at the Oval Office, Trump responded to a question from Decrypt about his willingness to appoint Democrats by stating,

“There are certain areas we do look at, and certain areas that we do share power, and I’m open to that.”

Traditionally, both the SEC and CFTC must include a minimum of two commissioners from a minority political party in their five-member boards. However, the CFTC currently has no Democratic commissioners, and the SEC will face a similar situation starting next year. Until now, Trump had shown no inclination to address these vacancies at either regulatory body.

Broader Context of Trump’s Administration

This announcement comes amidst Trump’s broader efforts to remove Democratic leadership from various federal agencies, challenging long-standing legal norms that have been in place for the past nine decades. Recently, the Supreme Court has hinted that it may overturn these precedents, potentially enabling Trump to dismiss federal agency commissioners at his discretion, which would undermine the autonomy of these institutions.

In his remarks, Trump expressed skepticism about the idea that a Democratic president would reciprocate by nominating Republicans for such positions, remarking,

“Do you think they would be appointing Republicans if it were up to them? Typically, they’re not appointing Republicans.”

However, historical patterns show that modern U.S. presidents, regardless of party affiliation, have often appointed individuals from the opposing party to lead federal agencies in compliance with existing laws.

Impact on Crypto Legislation

The dynamics surrounding federal regulatory appointments are particularly significant for the ongoing crypto market structure bill, which aims to formalize the operational framework of the cryptocurrency industry and allocate substantial regulatory authority to the SEC and CFTC. Key Senate Democrats have recently communicated to Decrypt that the bill’s chances of success hinge on assurances that Democrats will participate in regulatory processes moving forward.

Trump’s latest statements may alleviate some concerns among Senate Democrats regarding bipartisan representation at federal regulatory bodies. Nonetheless, if the Supreme Court ultimately permits Trump to terminate agency commissioners at will, he could still appoint Democrats but remove them at his convenience.

Legislative Timeline and Challenges

As for the crypto market structure bill, its progress has markedly slowed while bipartisan negotiators work to refine the details. Republican leaders had initially aimed for a summer passage, then sought to meet deadlines in October and before the year’s end. With Congress preparing for a recess as early as spring due to the upcoming 2026 midterm elections, time is running short.

Senator Tim Scott (R-SC), chair of the Senate Banking Committee, indicated on Monday that substantive discussions on the bill will not resume in committee until January 2026 at the earliest. A representative for Scott conveyed that the committee is yet to deliberate on the bill, emphasizing ongoing negotiations.

Conclusion

In summary, Trump’s newfound openness to Democratic nominations at key financial regulators may influence the fate of significant legislation intersecting with the fast-evolving world of cryptocurrency. However, with looming deadlines and a fragmented political landscape, the path forward remains uncertain.