Managing Your Cryptocurrency Keys

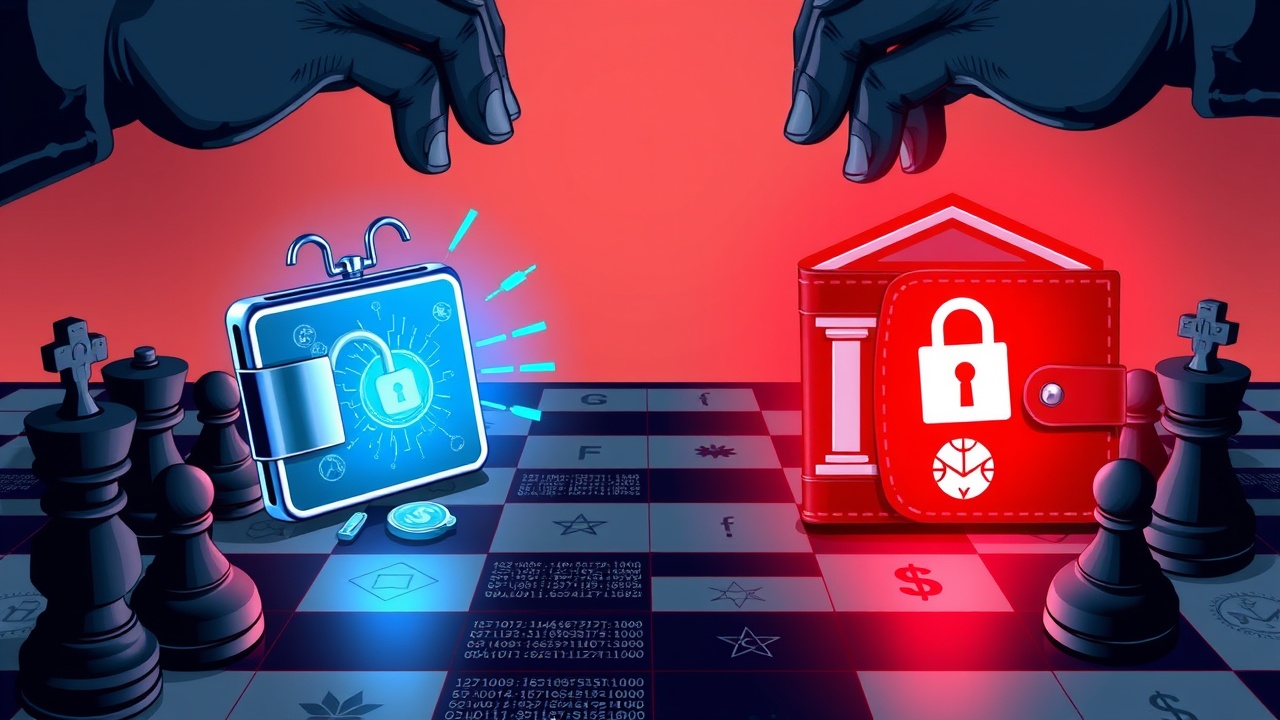

Imagine starting your day only to discover you cannot get into your cryptocurrency account, which can send anyone into a tailspin. You might have forgotten your password, or even worse, your wallet could have been compromised. This alarming thought raises an important consideration regarding digital asset management: who should be responsible for managing your cryptocurrency keys? Should you rely on an exchange to safeguard your investments or take the reins yourself?

Types of Cryptocurrency Wallets

When it comes to cryptocurrency wallets, there are primarily two types: custodial and non-custodial. Understanding their distinct functions can significantly impact your approach to securing your assets.

Custodial Wallets

A custodial wallet operates similarly to a traditional bank, storing your cryptocurrencies on your behalf. This method eliminates the hassle of memorizing complex private keys or managing intricate backup procedures. Such wallets are particularly user-friendly for novices and typically include customer support to assist users who may forget passwords or experience access issues. They seamlessly integrate with exchanges, facilitating the buy, sell, or trade processes without extensive hurdles.

However, entrusting a third-party platform with your keys carries inherent risks. If the exchange suffers a security breach, your funds could be jeopardized. Furthermore, you cede a degree of control over your assets to this third party.

Prominent custodial wallets include Coinbase Wallet and Binance Wallet, favored among both new and experienced traders.

Non-Custodial Wallets

In contrast, non-custodial wallets empower users by giving them complete control over their private keys. Think of it as having a personal vault, where you possess the unique combination. This control not only ensures ownership of your cryptocurrency but also enhances your privacy by eliminating any third-party interference.

While the benefits are substantial—no one can access your funds or freeze your account at will—this arrangement does place the onus of security squarely on the user. Should you misplace your private key or forget your backup phrase, your assets can be irretrievably lost. These wallets can also be more complex to use, potentially posing a challenge for those who are less technologically inclined.

Well-known non-custodial wallets include MetaMask for web access, along with hardware wallets such as Ledger and Trezor that provide an additional layer of protection for serious investors.

Choosing the Right Wallet

When weighing the options between custodial and non-custodial wallets, consider your willingness to assume responsibility. If the thought of managing your private keys fills you with dread, a custodial wallet might be the optimal choice. However, if you yearn for complete ownership and are keen to educate yourself, a non-custodial wallet could be an excellent fit.

Interestingly, many crypto enthusiasts choose to utilize a combination of both types of wallets—keeping some assets in a custodial setup for the sake of convenience, while preserving the remainder in a non-custodial wallet for long-term security. This dual approach allows users to enjoy the advantages of both systems.

Security Practices

For those opting for non-custodial wallets, it is crucial to safeguard your private keys and backup phrases diligently. Store them securely, consider using hardware wallets for enhanced security, and maintain strict confidentiality. Even custodial wallet users should adopt robust password policies and enable two-factor authentication to secure their accounts.

Ultimately, finding a wallet that caters to your unique needs can enhance your cryptocurrency experience and provide greater protection for your assets.

Conclusion

So, what stands out in your decision-making? Would you prefer the ease of custodial wallets or the autonomy of non-custodial ones? This choice primarily depends on your comfort with technology and the level of control you’re willing to exercise over your investments.

Stay informed about developments in wallet technology and best security practices to ensure that your cryptocurrency management remains both safe and rewarding.