Joint Roundtable on Cryptocurrency Regulation

In a significant development for the oversight of the cryptocurrency sector, the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) convened for their first joint roundtable in over 14 years. Held on Monday, this event aimed to address efforts for regulatory consistency, particularly as it relates to digital assets.

Key Remarks from Acting CFTC Chair

Acting CFTC Chair Caroline Pham, who currently holds the lone commissioner position at her agency after a series of departures in 2025, emphasized the potential impact of the two agencies collaborating on the future landscape for digital currency businesses.

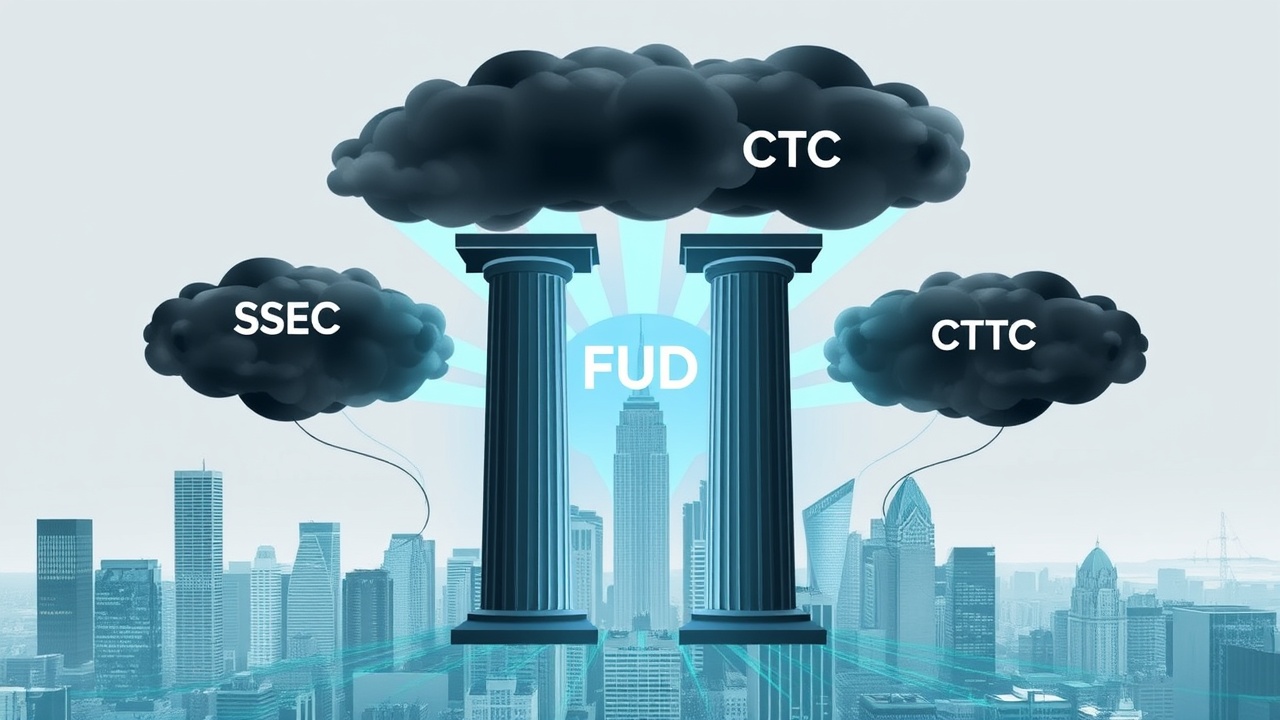

During her opening remarks, Pham aimed to alleviate concerns surrounding the CFTC’s activities in the crypto space, referring to misconceptions often summarized as “FUD,” or fear, uncertainty, and doubt. She highlighted that since she took office on January 20, the CFTC had enacted 18 actions—excluding enforcement cases—until early September. Alongside these, 13 enforcement actions were launched, with some specifically targeting digital assets. Following September 4, the agency initiated an additional 14 actions.

The CFTC is robust and operational, and there’s no cause for concern regarding our activities.

Industry Participation and Legislative Context

The roundtable also featured discussions with representatives from notable cryptocurrency firms, including Kraken and Crypto.com. Pham, being the sole serving CFTC commissioner present, collaborated with former CFTC leaders J. Christopher Giancarlo and Jill Sommers, who facilitated the discussions.

The timing of this roundtable coincides with rising tensions in Congress over several issues, especially a looming government shutdown linked to healthcare budget disputes. Should this shutdown occur, it would impede congressional operations, effectively putting a hold on the market structure bill that aims to define the jurisdictions of the SEC and CFTC in regulating digital assets.

Furthermore, the potential shutdown could exacerbate delays in appointing a successor to Pham, who has hinted at returning to the private sector if the Senate endorses Brian Quintenz, a nominee put forth by former President Trump. Originally slated for a committee vote in August, that process has been stalled at the request of the White House, allegedly instigated by the Winklevoss twins, prominent figures in the crypto industry, who sought assurances regarding future agency enforcement policies. As of now, Quintenz’s confirmation remains uncertain, with Trump reportedly exploring alternative candidates.