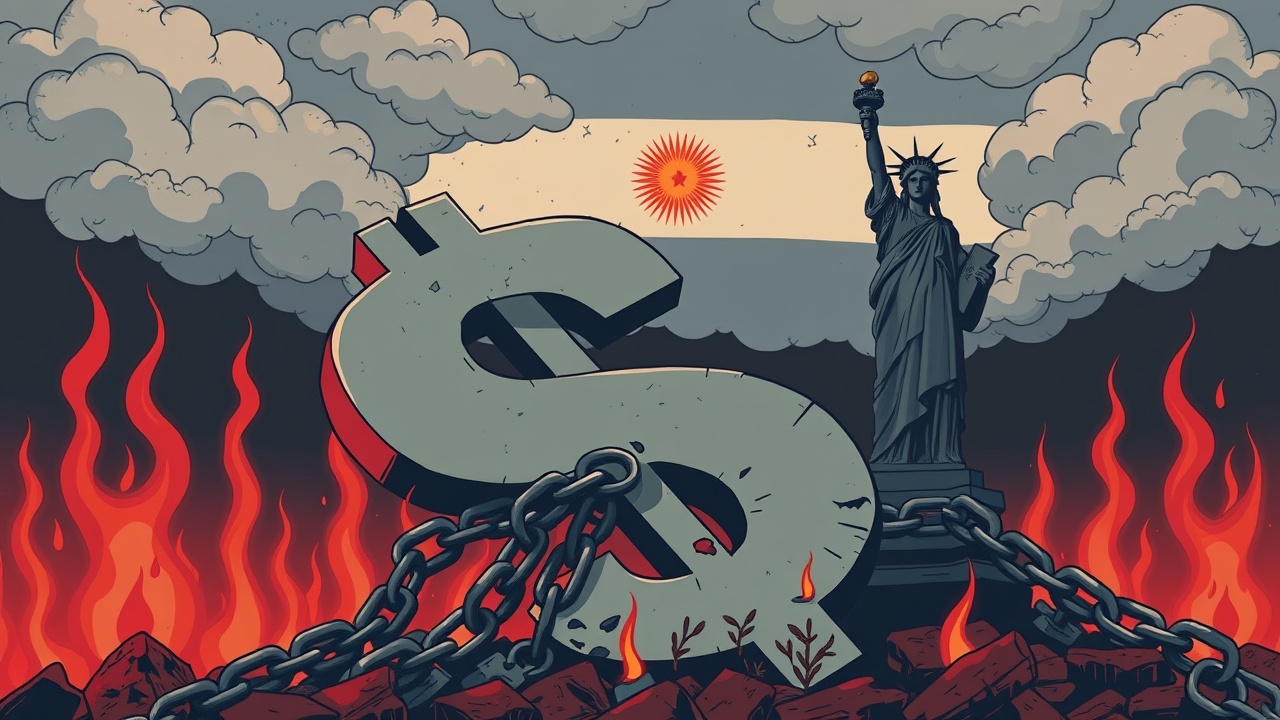

Concerns Over the US Dollar’s Future

In a recent analysis, macroeconomic strategist Luke Gromen has raised alarms about the potential decline of the US dollar amid soaring national debt, which has reached a staggering $36 trillion. During a YouTube briefing, Gromen indicated that the likely course of action for the United States will involve printing more currency to manage its debts, a situation that would inevitably lead to dollar depreciation rather than significantly increasing Treasury yields to draw in investors.

Risks in the Treasury Market

He elaborated that currently, the real risk affecting the Treasury market is not tied to credit, as the government can simply generate the funds needed to cover interest payments; thus, Treasury securities carry no credit risk, only a risk of inflation.

“What we’re witnessing with the adoption of Bitcoin by treasury companies is a result of the path we’ve been on, where people begin to grasp that the only resolution involves a steep devaluation of US and Western sovereign debt,”

he stated. Gromen suggests that, under these circumstances, the yield spreads for credit may remain relatively unchanged, as investors may prefer bonds from corporations like Apple or Microsoft over US Treasury bonds.

Potential Economic Downturn

Furthermore, he cautioned that the US economy might experience a downturn akin to that of Argentina, known for its severe inflation and currency devaluation. Gromen also noted a critical point: if the US government were to step back and permit any dysfunction within the Treasury market, the result would be explosive growth in credit risks, except possibly for gold, which may retain its value. However, he predicts that the government would not allow such an occurrence to persist for long, as pressure mounts from the administration on the Federal Reserve for lower interest rates to alleviate the debt burden and cut down fiscal challenges.

Current Market Performance

Currently, stocks might be performing well when measured in dollars, yet they are faltering in terms of gold or Bitcoin value. Gromen’s insights reflect a grim yet realistic view of the potential economic landscape, emphasizing the implications of the US’s handling of its immense national debt after decades of fiscal strategies.