World Liberty Financial Overview

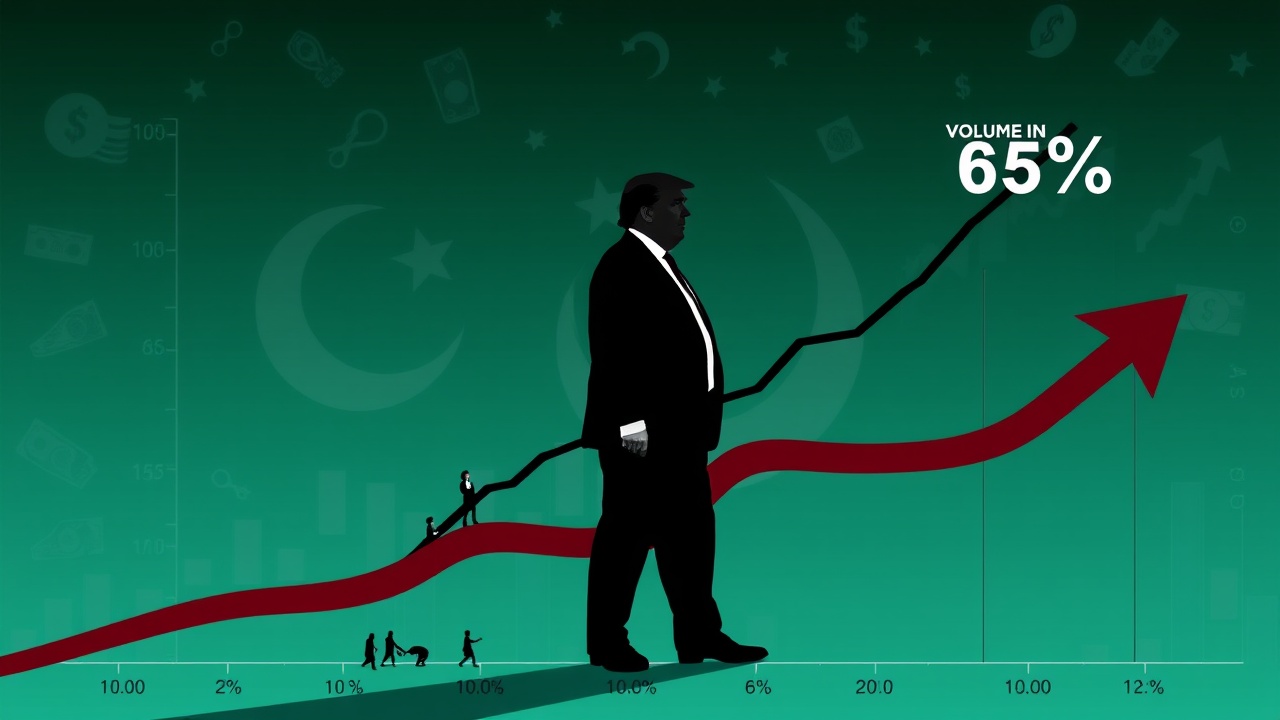

World Liberty Financial Incorporated (WLFI) is currently valued at $0.1799, marking a notable increase of 6.05% in the last 24 hours. This surge was amplified by a trading volume reaching $270.12 million, a significant rise of nearly 65%. Such vigorous market activity suggests renewed investor interest in the digital asset, which has seen a 29% price increase over the last month, positioning it as one of the more dynamic mid-cap tokens.

Partnership with the State Bank of Pakistan

The recent spike in WLFI’s prominence can be attributed to a pivotal agreement made with the State Bank of Pakistan that facilitates the integration of WLFI’s U.S. dollar-backed stablecoin, USD1, into Pakistan’s regulatory digital payment framework. This partnership, executed through SC Financial Technologies, a subsidiary of WLFI, was sealed on January 9. It stands out as one of WLFI’s initial collaborations with a national governing body.

Unlike operating outside regulatory supervision, USD1 will be incorporated within Pakistan’s formal financial system, highlighting its intended use as a complement to the nation’s existing digital financial infrastructure. Pakistani officials are optimistic about this development, as articulated by Finance Minister Muhammad Aurangzeb, who emphasized the need for global financial engagement while safeguarding regulatory frameworks and national interests.

Impact on Cross-Border Transactions

This agreement focuses significantly on cross-border transactions, particularly addressing the needs of the more than $30 billion sent home yearly by overseas Pakistanis through often inefficient banking systems. The government anticipates that employing regulated stablecoin will enhance transaction efficiency, cut costs, speed up settlements, and improve overall transparency. Given the economic importance of remittances in Pakistan, even slight enhancements in efficiency could lead to substantial economic benefits.

Regulatory Developments and Future Prospects

Additionally, Pakistan is contemplating comprehensive regulations for virtual assets and is piloting programs for a central bank digital currency, indicating a systematic approach rather than mere opportunistic moves. Notably, just a few years ago, Pakistan was firmly opposed to cryptocurrencies, mainly due to concerns about financial stability; however, with shifting perspectives globally, especially in the U.S., there is now a notable embrace of blockchain as a modernizing tool.

This development coincides with noticeable thawing relations between the U.S. and Pakistan under a government that is more accepting of cryptocurrencies. Nevertheless, experts have raised alarms regarding data security and the geopolitical ramifications tied to this agreement, particularly amid ongoing tensions in South Asia.

World Liberty Markets and Future Innovations

In tandem with the Pakistan partnership, World Liberty Financial has also unveiled “World Liberty Markets”, a lending and borrowing platform that leverages Dolomite’s liquidity infrastructure. This enables users to lend assets ranging from USD1 and WLFI to popular cryptocurrencies like ETH and USDT to earn interest or borrow funds against their holdings. Utilizing Dolomite’s existing framework allows WLFI to expedite service rollout without having to construct the lending protocol from the ground up.

World Liberty Markets aims to lay the groundwork for future developments, allowing WLFI token holders a voice in governance decisions relating to collateral types and market parameters. It will also venture into tokenized real-world assets, expanding the service offerings.

Looking forward, plans include the launch of a WLFI mobile app that would feature USD1-centric card payments, with the necessary backing and transparency via treasury support. If USD1 is successfully integrated across multiple financial activities like lending and remittances, WLFI could serve as a case study in how stablecoins can be utilized as structured financial tools rather than just volatile assets.